14th March’14 Banknifty Future levels

Banknifty Future closed : 12196

Overall trend is very positive but some profit taking will be expected!!

Rupee now 61 + IIP 0.1 + Inflation already down…… more positive news is there

Banknifty Future support 12120 below 12050 next support

Thereafter 11950 levels……

Today’s Resistance 12270 & 12400

AXISBANK below 1395

More panic upto 1375, 1355 levels…….

Rise to sell with stop-loss of 1410!!!

Updated : 08.56am / 14th March’14

14th March’14 Hot Calls

TATASTEEL

TATASTEEL Below 336 more panic on the card!!

Down side support 331, 328 thereafter 323 levels

Sell on rise!!!!

SSLT

SSLT (Sesa sterlite) is not participate in recent Rally

Strong support around 172……..

Once if break & sustain below 168, 165 will test

APOLLOTYRE

Tyre stocks looks Good

APOLLOTYRE now ready to Big move

Once if crossover the level………???

Clients special call

1 Lac Profit Plan

Active trader’s Best package 1 Lac Profit Plan

We are online with you 8.45am to 4pm

Alert given with quantity (SMS and Yahoo both)

Charges Rs 20000/ 1 lac Profit

When 1 lac Profit will reached then susbcription will be expired!!!

More details call us : 098659 77321 (ARJUN)

Trade for U plan also available!!!

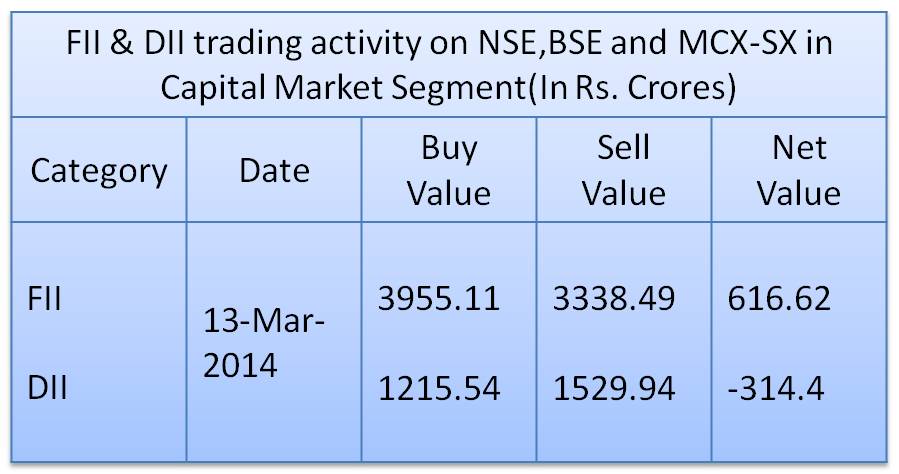

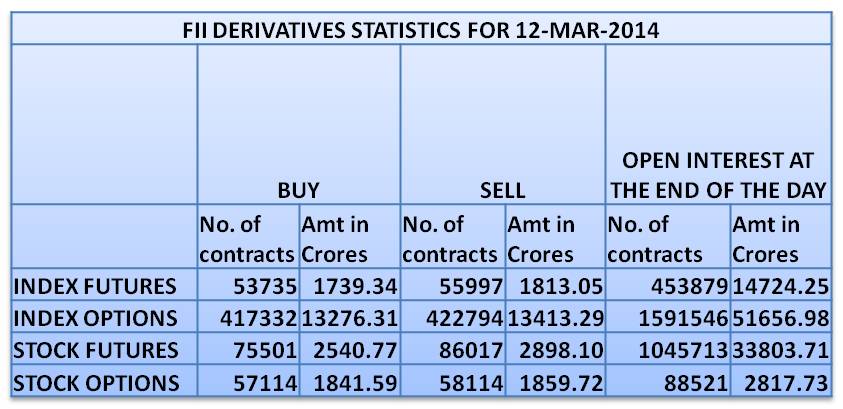

Nifty Future not crossed our Resistance level 6595….. How is FII’s Game!!!

Last Three days we have written Nifty Future Resistance 6595

Today morning & noon also same level posted!!!

Made a high was 6588.80 then sustained 6570 levels

After 2.30pm……… Huge selling and crashed 6503.30 level

How is FII’s Game!!! 100% manipulative in our market

Again Nifty Future Narrow Range…..

Again Nifty Future traded very narrow range

Moving 6570 to 6585 levels…… but near by recent resistance level

Already told level 6595…….. if sustain above the level

Rally expected upto 6625 & 6640 levels

If close above 6595 continue Two days & week close also Target 6750 to 6900!!!

Updated : 01.37pm / 13th March’14

13th March’14 Nifty Future Update

Last Two Days Nifty Future traded very Range Market

Yesterday made a high was 6579.45, low was 6515.05, then closed 6549.25

Overall trend is very Positive but range market!!

![]()

We are not change the levels

Today Nifty Future facing Resistance 6595

If sustain above the level will move 6625 & 6650 levels

Today’s Support 6510 (Spot 6487)…….. if stays below the level

Panic selling will be expected upto 6480 & 6455 levels

More Live Market update to our clients only

Updated : 08.58am / 13th March’14

13th March’14 Banknifty Future levels

Banknifty Future closed : 12090

NAMO + RAJAN : Banknifty Future 14000++

Banknifty Future facing Resistance 12200 & 12350

If sustain and close above 12350……… Rally expected upto 13000

Today’s Support 12030 and 11940 levels……. thereafter more panic

More live market update to our clients only!!!

Updated : 08.50am / 13th March’14

13th March’14 Hot Calls

TITAN

TITAN Consisder Resistance @ 258.50

If crossover the level…….. All round buying will see

Target 262, 265 levels

SSLT

SSLT (Sesa sterlite) is not participate recent Rally

Strong support around 172……..

Risky trader can buy with stop-loss of 172

Suppose once if break????

BEML

BEML now ready to Big Blast!!!

Today once if crossover the level

Rally expected upto 5% to 10%……

Clients special call

OPTIONS

Weekly min 3 to 5 Options

All are Positional with max 5 days holding period

Max 3 position are opened

Complete follow up messages

Charge Rs 4500/pm ( 10% Offer)

Updated : 08.36am / 13th March’14

Bank of Thailand cuts interest rates to 2%

The prospect that political unrest will dent the Thai economy forced the Bank of Thailand to cut its benchmark interest rate on Wednesday.

The BoT cut the policy rate by a quarter point to 2 per cent, as widely anticipated.

The central bank cited “prolonged political uncertainties” that will impede private consumption, investment, and tourism, though it said exports should gradually improve.

The central had kept rates steady at its January meeting, but by a narrow 4-3 vote. Today’s decision to cut rates was also a 4-3 decision.

With inflation running below a 2 per cent annual rate last month, economists correctly assumed the BoT had the ammunition to help stimulate the economy amid ongoing protests.

Prior to the decision economists at HSBC wrote:

With the caretaker government’s hands bound with regards to new spending, it is now solely up to the central bank to step up to the plate and mitigate further downside risks to the economy as best as it can.

The BoT noted in its statement:

Core inflation has edged up, but remains subdued. Monetary policy has some scope to ease, in order to lend more support to the economy and ensure continuous financial accommodation