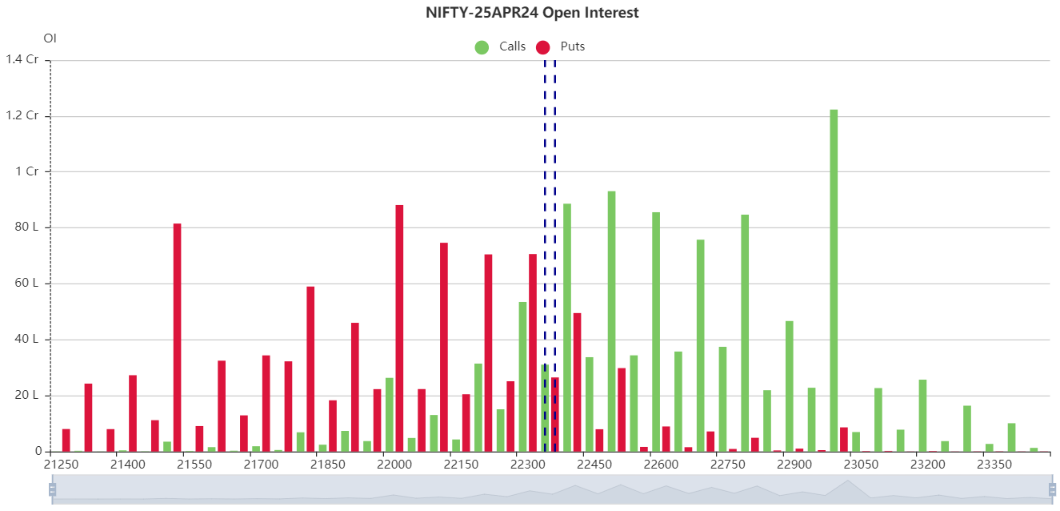

26th April 2024 #Nifty Intraday Levels and Pre-Market Reports

Nifty last close: 22570.35 (+0.75%)

The Indian market made a smart recovery from the day’s low to extend the winning streak to a fifth straight session on April 25

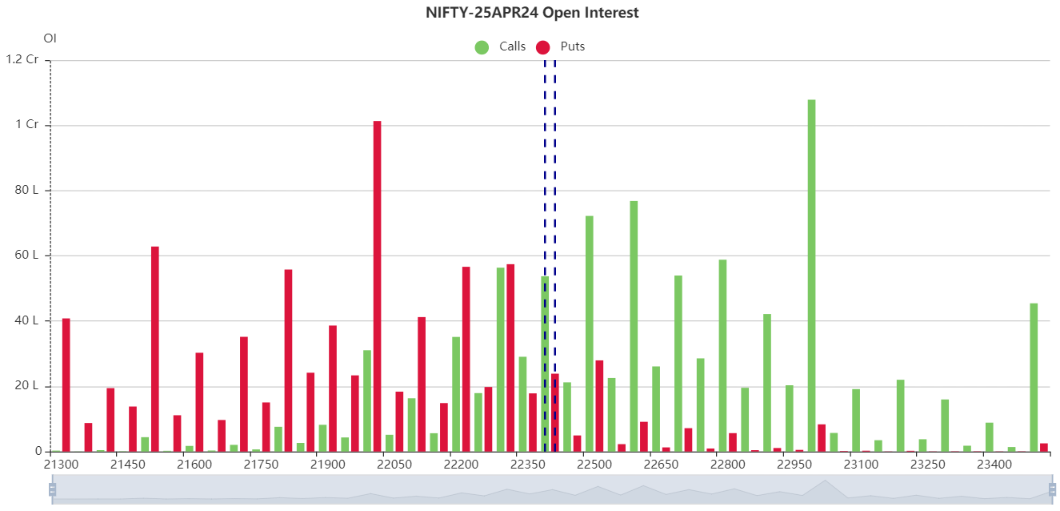

Nifty was seen huge volatility on April series expiry day

Finally, Nifty was up 167.90 points, or 0.75 percent, at 22,570.30

Sensex was up 486.50 points, or 0.66 percent, at 74,339.44

Biggest Nifty gainers were Axis Bank, SBI, Dr Reddy’s Labs, JSW Steel and Nestle India

while losers included Kotak Mahindra Bank, LTIMindtree, HUL, SBI Life Insurance

Among sectors, except realty, all indices ended in the green

PSU Bank index rising nearly 4 percent to hit a record high of 7,421.20

midcap and the smallcap indices gained 0.5 percent each

IT services major Tech Mahindra reported a 40.9 percent fall in net profit to Rs 661 crores year-on-year

Bajaj Finance has reported net profit at Rs 3,825 crore for March FY24 quarter, growing 21% over corresponding period of last fiscal

Foreign institutional investors (FIIs) net sold Rs 2,823.33 crore shares

while domestic institutional investors (DIIs) pumped in Rs 6,167.56 crore on April 25

US markets ended sharply lower on April 25

US economic growth slows in first quarter

Gross domestic product increased at a 1.6% expected of 2.3%

Dow lost 0.98%, Nasdaq declined 0.65% and S&P500 declined 0.46%

US VIX fell 4% to 15.37

Alphabet hits record high on strong Q1 earnings

Microsoft surges nearly 5% on beat earnings report

Meta recovered slightly from day’s low

Intel slides 8% after weak earnings report

US 10-year yield hits highest level in over 5 months at 4.7%

Gold prices sustains around $2330/oz

Grude sustains around $90/bbl

Asian markets were set to higher note

Nikkei up 0.4% and Hangseng up 1.7%

GiftNifty indicates a positive opening for the index

Nifty is facing a intraday resistance 22630 and 22660

If stays above 22660 will try to move 22730

On other side, Nifty considering a supports 22540 and 22500

Below 22500 finding a next support around 22440

Updated: 08.54 am / 26th April 2024

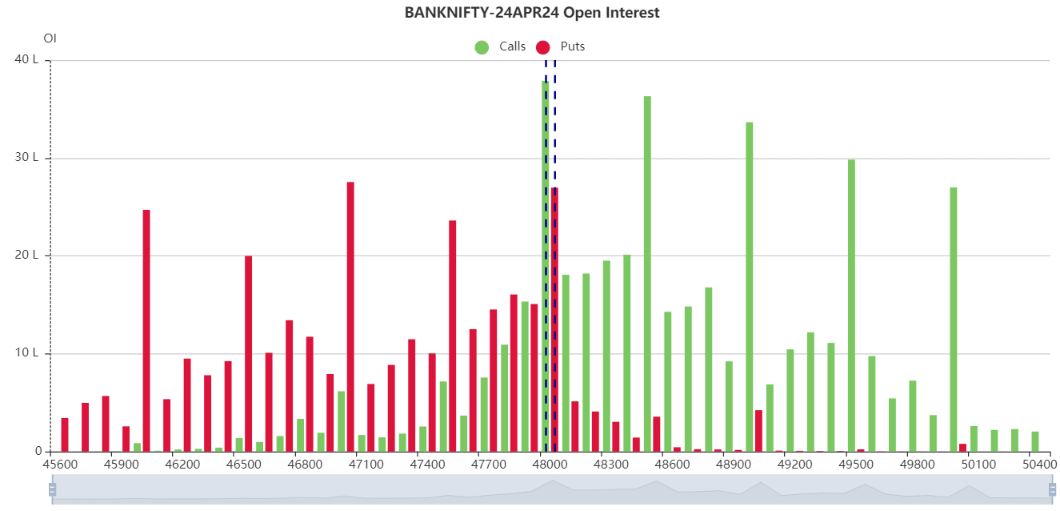

26th April 2024 #Banknifty Intraday Levels

Banknifty last close: 48494.95 (+0.63%)

Today Banknifty is facing a intraday resistance 48650 and 48750

If stays above 48750 will try to move 49000

On other side, Banknifty considering a supports 48330 and 48200

Below 48200 finding a next support around 48000

Updated: 08.43 am / 26th April 2024

25th April 2024 Nifty and Banknifty Levels

Today’s Nifty, Banknifty supports, resistance levels and open interest data will be sharing to my free telegram channel

Free telegram channel link is https://t.me/FlyingcallsArjun

24th April 2024 #Nifty Intraday Levels and Pre-Market Reports

Nifty last close: 22368 (+0.14%)

The Indian market squandered most of the day’s gains in last-hour selling on April 23

The Nifty closed with modest gains to end higher for a third session in a row

Nifty was up 31.60 points, or 0.14 percent, at 22,368

Sensex was up 89.83 points, or 0.12 percent, at 73,738.45

Grasim Industries, Bharti Airtel, Nestle India, Maruti Suzuki and HCL Technologies

while losers included Sun Pharma, BPCL, Reliance Industries, M&M

Among sectors, healthcare, metal, oil & gas and energy were down 0.3-0.8 percent

while FMCG, power, IT, realty and auto were up 0.4-2 percent

Midcap index rose 0.5 percent and the smallcap index gained a percent

Volatility Index slides 20% to record biggest single-day fall since May 2019

India VIX reaches level of 10 for the first time since November 24, 2023

Rupee ends at 83.34/$ against Monday’s close of 83.36/$

Foreign institutional investors (FIIs) net sold shares worth Rs 3,044.54 crore

while domestic institutional investors (DIIs) bought Rs 2,918.94 crore worth of stocks on April 23

US markets ended higher on April 23

Dow gained 0.69%, Nasdaq rallied 1.59% and S&P500 added 1.2%

US VIX fell 7.4% to 15.69

Tesla up 10% in extended trading after the earnings report

General Motors up 4% after the company announced strong annual forecast

Crude sustained $88/bbl

Gold prices extended fall below $2340/oz

Asian markets were set to higher opening in early trade

Today’s Nifty supports and resistance levels. Open interest data will be sharing to my free telegram channel

Free telegram channel link is https://t.me/FlyingcallsArjun

Updated: 09.00 am / 24th April 2024

24th April 2024 #Banknifty Intraday Levels

Banknifty last close: 47970.45 (+0.1%)

Today Banknifty is facing a intraday resistance 48100 and 48200

If stays above 48200 will try to move 48350

Today Banknifty considering a supports around 47900 and 47800

Belo 47800 finding a next support around 47650

Updated: 08.38 am / 24th April 2024

23rd April 2024 #Nifty Intraday Levels and Pre-Market Reports

Nifty last close: 22336.40 (+0.86%)

The Indian equity indices extended gains for the second straight session on April 22

Market started gap-up and remained rangebound with positive bias throughout the session

Finally, Nifty was up 189.40 points, or 0.86 percent, at 22,336.40

Sensex was up 560.29 points, or 0.77 percent, at 73,648.62

Top Nifty gainers included BPCL, Tata Consumer Products, Eicher Motors, L&T

while losers were NTPC, HDFC Bank, JSW Steel, IndusInd Bank and Tata Steel

All sectoral indices ended in the green

Auto, PSU bank, capital goods, oil & gas, FMCG, healthcare and realty indices gained up to 3 percent

midcap and smallcap indices each closed a percent higher

Reliance Industries Ltd (RIL) said net profit rose 0.1 percent to Rs 21,243 crore for the fiscal fourth quarter

The company’s board approved a dividend payout of Rs 10 per share

The company reported revenue of Rs 2.41 lakh crore in the three months ended March 31

Foreign institutional investors (FIIs) net sold shares worth Rs 2,915.23 crore

while domestic institutional investors (DIIs) bought Rs 3,542.93 crore worth of stocks on April 22

US markets ended green on April 22

Dow gained 0.67%, Nasdaq rallied 1.1% and S&P500 added 0.87%

Nvidia jumps 4% and Tesla slipped to 3%

US 10-year yield sustained around 4.62%

A firm US dollar had the yen locked near a fresh 34-year low on Tuesday

Gold prices dropped more than 2 percent to a one-week low on Monday

Gold prices slashed below $2300/oz

Asian markets mixed in early trade

Hangseng up 0.5% and Nikkei flat note

GiftNifty indicates a positive note for the index

Nifty is facing a intraday resistance 22380 and 22440

If stays above 22440 will try to move 22500

On other hand, Nifty considering a supports 22300 and 22260

Below 22260 finding a next support around 22200

Updated: 08.52 am / 23rd April 2024

23rd April 2024 #Banknifty Intraday Levels

Today’s Banknifty supports, resistance levels and open interest will be sharing to my free telegram channel.

Free telegram channel link is https://t.me/FlyingcallsArjun

Updated: 08.34 am / 23rd April 2024