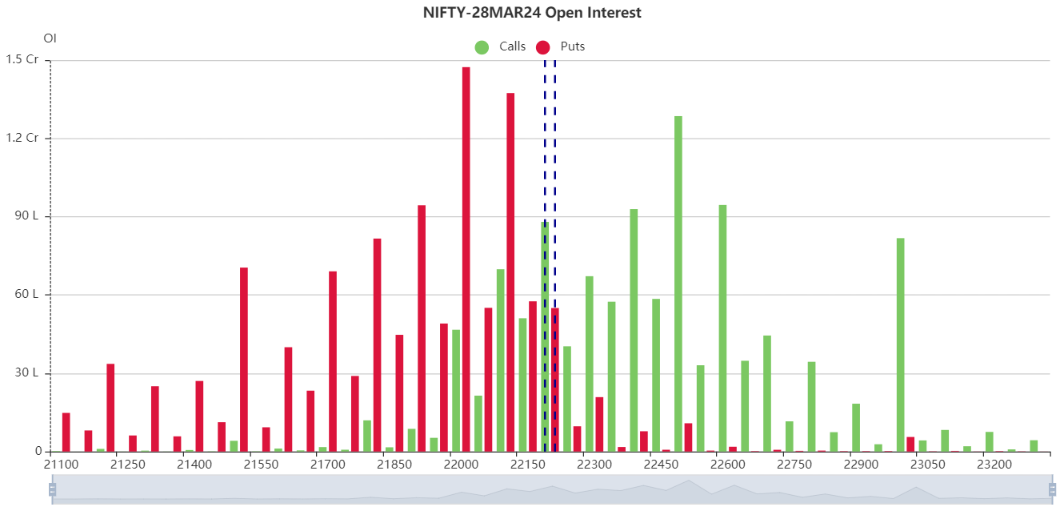

28th March 2024 #Nifty Intraday Levels and Pre-Market Reports

Nifty last close: 22123.65 (+0.54%)

Nifty was ended higher note due to positive global cues

Nifty up 119 points to 22,124 and Sensex rises 526 points to 72,996

Biggest gainers on the Nifty were Reliance Industries, Maruti Suzuki, Bajaj Auto, Bajaj Finance

while losers included Hero MotoCorp, Tata Consumer Products, Apollo Hospitals, Dr Reddy’s

Among sectors, auto, bank, capital goods, power, realty, telecom were up 0.5-1 percent

while metal, IT, media down 0.3-0.5 percent

midcap index ended on a flat note and the smallcap index gained 0.7 percent

BSE releases list of 25 stocks available for T+0 settlement starting March 28

The Centre will borrow Rs 7.50 lakh crore via the issuance of government securities in the April-September period of FY25

Foreign institutional investors (FIIs) net bought shares worth Rs 2,170.32 crore

while domestic institutional investors (DIIs) purchased Rs 1,197.61 crore worth of stocks on March 27

Cloverdell Investment likely to sell its entire stake in IDFC First Bank via block deals

Shareholders approve delisting of company and share-swap ratio

For every 100 shares of ICICI Sec, 67 shares of ICICI Bank will be share-swap ratio

The offer size is likely to be at Rs 1,191.40 crore and the company is looking to sell 15.9 crore shares

The floor price set at Rs 75 per share, implying 4 percent discount to current market price

US markets ended higher on March 27

Dow gained 1.22%, Nasdaq rallied 0.52% and S&P500 added 0.86%

S&P500 postes record close on March 27

US 10-year bond yield falls to 4.1% from 4.2%

Crude sustains $86/bbl

JPMorgan expects Russia’s actions to push Brent crude to $100 by Sept

Gold sustains $2200/oz

Australlian index hits record high in opening trade on Thursday

Asian markets were set to mixed opening for early morning

Nikkei down 1% and Hangseng up 0.85%

GiftNifty indicates a positive opening for the index

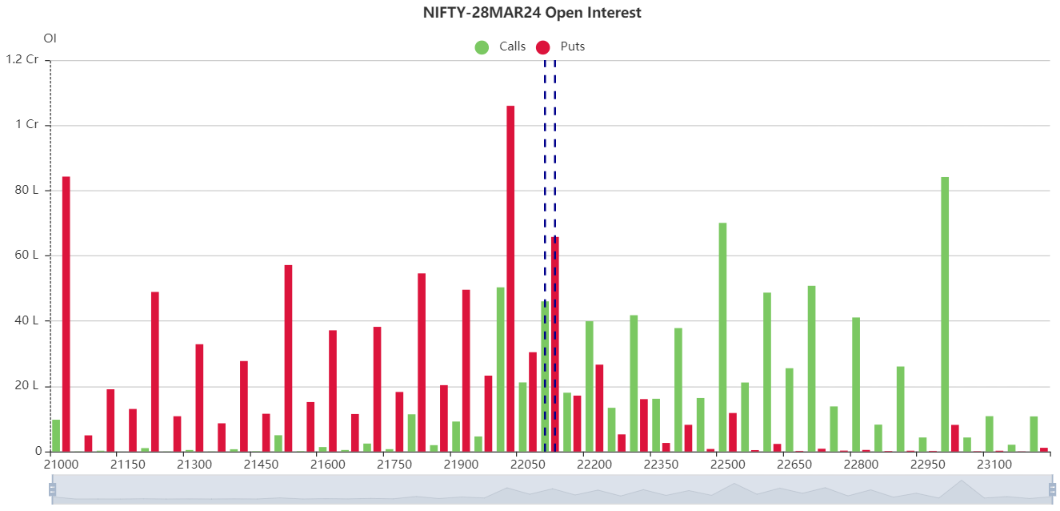

Nifty is facing a intraday resistance 22150 and 22185

If stays above 22185 will try to move 22240

On flip side, Nifty considering a supports 22100 and 22080

Below 22080 finding a next support around 22040

Updated: 08.52 am / 28th March 2024

28th March 2024 #Banknifty Intraday Levels

Today’s Banknifty supports and resistance levels will be sent to my Free Telegram channel

Free telegram channel link is https://t.me/FlyingcallsArjun

Updated: 08.38 am / 28th March 2024

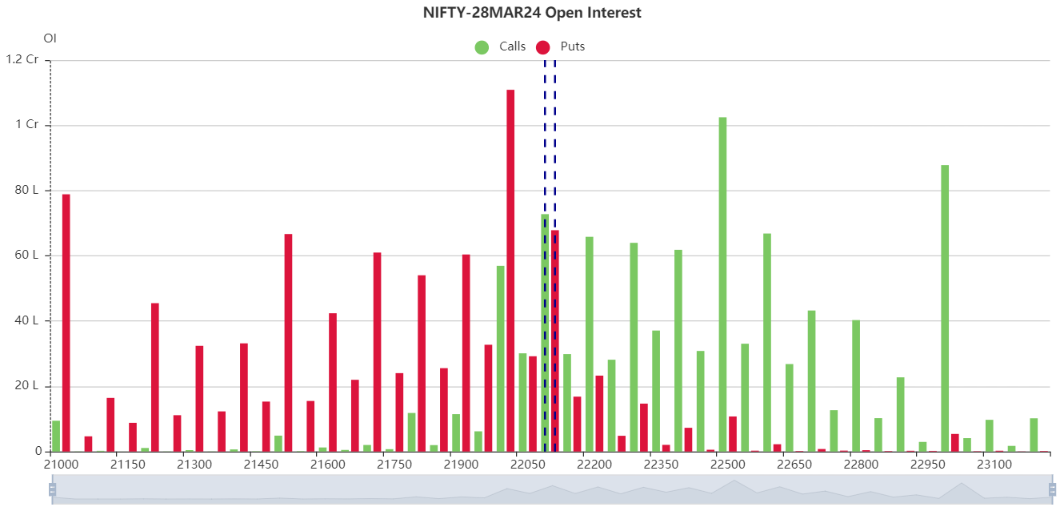

27th March 2024 #Nifty Intraday Levels and Pre-Market Reports

Nifty last close: 22004.70 (-0.42%)

The markets broke three-day winning momentum and ended lower in the volatile session on March 26

Nifty was opened around 22000 and seen strong consolidation around 22000-22050

Finally, Nifty was down 92.10 points, or 0.42 percent, at 22,004.70

Sensex was down 361.64 points, or 0.5 percent, at 72,470.30

Bajaj Finance, Hindalco Industries, Britannia Industries, Adani Ports and L&T were among the top gainers

while losers were Power Grid Corporation, Eicher Motors, Bharti Airtel, Kotak Mahindra Bank and Wipro

On the sectoral front, Bank and Information Technology indices were down 0.5 percent each

while Capital Goods, Realty, Oil & Gas, Metal indices gained 0.5-1 percent

India’s current account deficit narrows to $10.5 billion in October-December

Foreign institutional investors (FIIs) net bought shares worth Rs 10.13 crore

while domestic institutional investors (DIIs) purchased Rs 5,024.36 crore worth of stocks on March 26

US markets erase opening gains and ended day’s low on March 26

Dow ended almost flat, Nasdaq down 0.42% and S&P500 fell 0.28%

US VIX settled around 13.2

Nvidia fell almost 4% from record high

Trump Media and Tech group jumps 25% on its stock market debut

Crude falls and settled around $86/bbl

US 10-year yield slips from 4.3% to 4.2%

Gold hits record high $2220/oz

Asian markets were set to mixed opening in the early morning

Nikkei up 1% and Hangseng down 0.6%

GiftNifty indicating a flat opening for the index

Nifty is facing a intraday resistance 22035 and 22060

If stays above 22060 will try to move 22100

On flip side, Nifty considering a supports around 21990 and 21970

Below 21970 finding a next support around 21930

Updated: 08.45 am / 27th March 2024

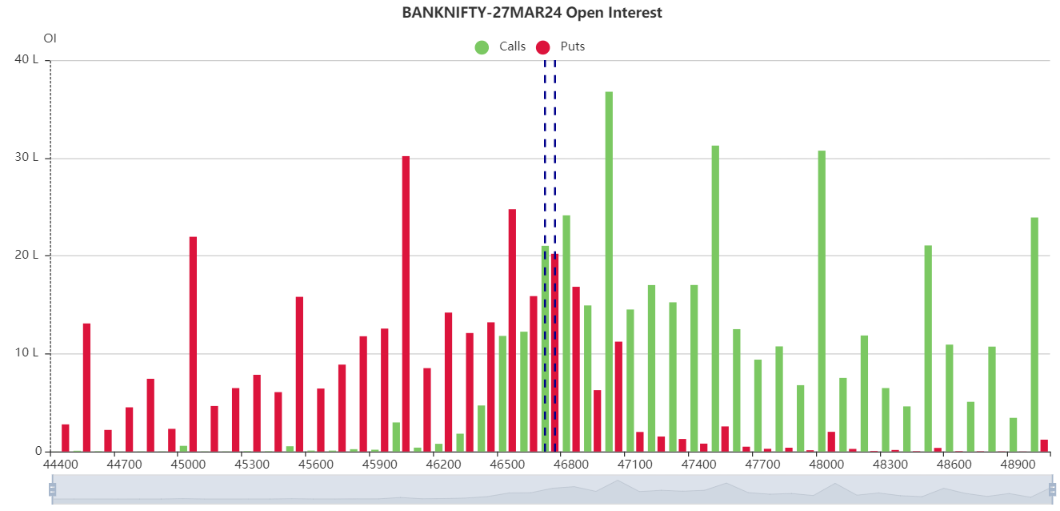

27th March 2024 #Banknifty Intraday Levels

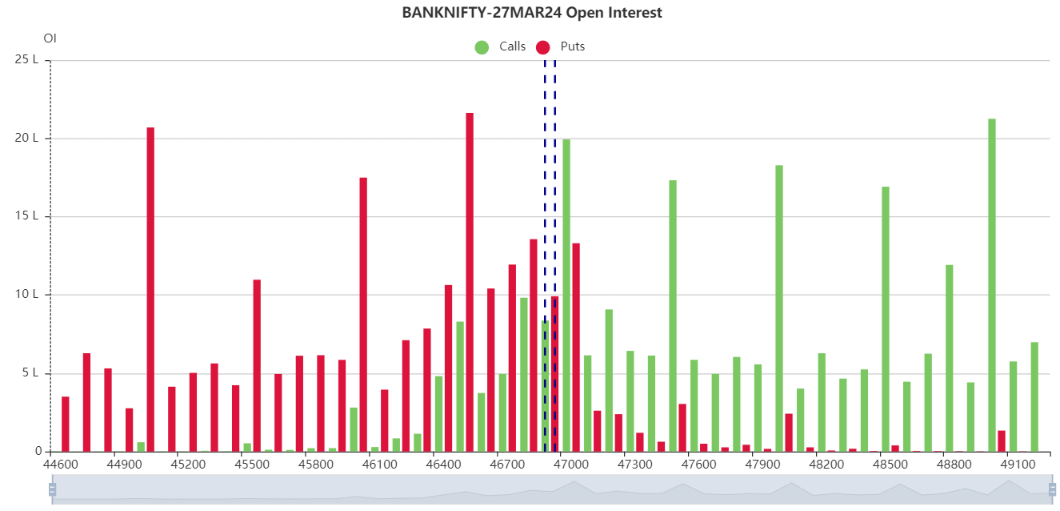

Banknifty last close: 46600.20 (-0.56%)

Today Banknifty is facing a intraday resistance 46700 and 46800

If stays above 46800 will try to check 47000

On other side, Banknifty considering a supports 46550 and 46450

Below 46450 finding a next support around 46250

Updated: 08.30 am / 27th March 2024

26th March 2024 #Nifty Intraday Levels and Pre-Market Reports

Nifty last close: 22096.75 (+0.39%)

Broader indices recovered some of the previous week’s losses

Outperformed the main indices in the week ended March 22

Last week, BSE Sensex added 188.51 or 0.25 percent to close at 72,831.94

Nifty50 index rose 73.45 points or 0.33 percent to end at 22,096.80

Nifty Realty index rose 5.4 percent, the Nifty Auto and Metal indices added 4 percent each

while the Nifty Information Technology index lost 6 percent

Small-cap, Mid-cap, and Large-cap indices rose 1.8 percent, 1.4 percent, and 0.6 percent, respectively

During the week, FIIs increased their selling as they sold equities worth Rs 8,365.53 crore

Domestic institutional investors (DIIs) bought equities worth Rs 19,351.62 crore

Beige Ltd is going to sell up to 2.90 percent stake in Mankind Pharma via block seals

Beige currently holds 2.99 percent stake in Mankind Pharma

The offer price is in the range of Rs 2,103-2,214 per share

ICICI Securities receives administrative warning from SEBI

US markets ended lower on March 25

Dow lost 0.4%, Nasdaq slipped to 0.27% and S&P500 down 0.3%

Nvidia hits record highs level after market hours

US 10-year yield around 4.3%

Spot gold gained 0.5 percent to $2,175.68 per ounce

The dollar index was last 0.02 percent lower at 104.20

Bitcoin tops $70,000 again after slumping on US ETF outflows

Asian markets were set to higher opening in the early trade

Hangseng up 0.4% and Nikkei down 0.10%

GiftNifty indicates a flat opening for the index

This week trend decider 22200 and 21830

Nifty is facing a intraday resistance 22140 and 22175

If stays above 22175 finding a next resistance 22250

On flip side, Nifty considering a supports 22050 and 22010

Below 22010 will try to check 21950

26th March 2024 #Banknifty Intraday Levels

Banknifty last close: 46863.75 (+0.38%)

This week Banknifty trend decider 47000 and 46500

Today Banknifty is facing a intraday resistance 46950 and 47050

If stays above 47050 will try to check 47200

On flip side, Banknifty considering a supports 46750 and 46650

Below 46650 finding a next support around 46500

Updated: 08.29 am / 26th March 2024

22nd March 2024 #Nifty Intraday Levels & Pre-Market Reports

Nifty last close: 22011.95 (+0.79%)

Sensex and Nifty 50 ended higher on March 21 tracking a rally in global markets

Nifty was opened 22000 and went to 22070 then fell to 21940

Finally, Nifty 50 was up 175.70 points or 0.80 percent at 22,014.80

Sensex was up 590.60 points or 0.82 percent at 72,692.29

The biggest gainers on the Nifty 50 included BPCL, NTPC, Tata Steel, Power Grid Corp

while the top losers included Bharti Airtel, ICICI Bank, HDFC Life, Maruti Suzuki

With all sectors ending in green

Nifty Realty and Nifty PSU Bank rose the most and Nifty Bank and Nifty FMCG saw the least gains

Midcap and BSE Smallcap added over 2 percent gains

BSE-listed companies gain Market Cap of ?5 lakh crore on Thursday

Bank Of England (BoE) keeps interest rates unchanged at 5.25%

Accenture cuts #FY24 revenue growth guidance to 1-3% from 2-5%

SWISS NATIONAL BANK RATE DECISION: 1.50%; EST. 1.75%; PREV. 1.75%

TURKEY’S CENTRAL BANK DELIVERS ITS NINTH STRAIGHT RATE HIKE, RAISING RATES TO 50% FROM 45%

Sebi issues framework for beta version of T+0 settlement; to start with 25 scrips and limited trade timing

US weekly jobless claims unexpectedly fall; labor market gradually cooling

Foreign institutional investors (FIIs) net sold shares worth Rs 1,826.97 crore

while domestic institutional investors (DIIs) bought Rs 3,208.87 crore worth of stocks on March 21

US Markets ended higher on March 21

Dow gained 0.68%, Nasdaq rallied 0.2% and S&P500 gained 0.32%

US VIX at 12.92

Accenture down 9% after weak guidance and Apple falls 4%

Gold prices falls near $2180/oz

Brent crude futures fell 18 cents to $85.60 a barrel

Asian markets largely lower on early trade

Nikkei flat and Hangseng down 2.2%

GiftNifty indicates a negative opening for the index

Nifty is facing a intraday resistance 22050 and 22080

Above 22080 will try to move 22130

On other hand, Nifty considering a supports 21970 and 21930

Below 21930 finding a next support around 21880

Updated: 08.40 am / 22nd March 2024