18th Aug’14 Banknifty Future Levels

Banknifty Future closed : 15123

Thursday BNF traded very Low volume……

In Low volume our clients Booked almost 70 points Profits!!!

Today’s BNF facing Resistance 15190 & 15250 levels

There after we see FIRE work………….

Today’s Supports 15060 & 14980 levels………

More live market update to our clients only

SBIN Support at 2350 & 2340 levels

There after more panic on the card up to 2320 levels

Today’s Resistance 2383 & 2400 levels

Updated : 08.42am / 18th Aug’14

18th Aug’14 Hot Calls

TATAMOTORS

TATAMOTORS facing Strong Resistance level 488

Once If crossover the levels……….

We see Rally up to 493 & 498 levels

DLF

DLF will have strong support at 190 levels

Lower levels can buy and keep stop-loss of 190

Expected Target 202, 209……….

Suppose if breaks 190 and closes below the levels

Will check 183 & 175++ shortly!!!

BATAINDIA

BATAINDIA now near by Strong Resistance levels

Today once if breaks the Level

Non stop Rally will be expected up to 1240 & 1250

Clients special call

GUESS….

Today’s GUESS………

XXXX BUY ABOVE 542 TARGET 550,554

STOP-LOSS 539

Clients special call……….

Updated : 08.37am / 18th Aug’14

Sun Pharma unit recalls mutiple lots of capsules from US

Caraco Pharmaceutical Laboratories, a unit of Sun Pharma , has initiated a recall of multiple lots of Cephalexin capsules from the US market.

According to a notification by the USFDA, the recall of the 3,40,553 units of 500 mg and 1,13,677 units of 250 mg bottles is voluntarily initiated by the company through a letter to the regulator in June under ‘Class-II’ classification. Cephalexin is an antibiotic that belongs to the family of medications known as cephalosporins. It is used to treat certain types of bacterial infections. “CGMP Deviations:

These products are being recalled because they were manufactured with active pharmaceutical ingredients (APIs) that were not manufactured with good manufacturing practices,” USFDA’s website said citing the reason for recall. When contacted, a Sun Pharma spokesperson offered no comments.

The recalled drug bottles were distributed by Caraco Pharmaceutical Laboratories, Ltd in the US while manufactured in India by Sun Pharmaceutical Industries Ltd. According to American health regulator USFDA, Class II recall is a situation in which use of or exposure to a violative product may cause temporary or medically reversible adverse health consequences or where the probability of serious adverse health consequences is remote.

Recently Caraco Pharmaceutical had said that it initiated a recall of some lots of Venlafaxine Hydrochloride extended-release tablets from the US market for not meeting the drug release dissolution specifications under ‘Class-II’ classification.

Meanwhile, in another notification FDA said Wockhardt USA has initiated a recall of 840 bottles of Bupropion hydrochloride extended-release tablets USP (SR), 100 mg, (500-count bottle) from USA market. The reason for recall: “Out of specification levels of the impurity m-chlorobenzoic acid were observed’. Bupropion hydrochloride extended-release tablets (SR) are indicated for the treatment of major depressive disorder.

US Stocks Erase Losses as Ukraine Conflict Boosts Oil Prices

US. stocks erased losses as increasing violence in Ukraine sent oil prices to the biggest increase in a month and spurred a rally in energy producers.

Anadarko Petroleum Corp., Cimarex Energy Co. and Kinder Morgan Inc. led a measure of oil and natural gas producers in the Standard & Poor’s 500 Index to a 0.5 percent advance, the most among 10 main industries. Nordstrom Inc. sank 5.2 percent after reporting sales that missed analysts’ estimates. Monster Beverage Corp. soared 30 percent after Coca-Cola Co. agreed to buy a stake in the company.

The S&P 500 (SPX) pared declines in the late afternoon, ending the day little changed at 1,955.06 as 4 p.m. in New York. It earlier fell as much as 0.7 percent. The Dow Jones Industrial Averageslid 50.67 points, or 0.3 percent, to 16,662.91. About 6 billion shares changed hands on U.S. exchanges today, 5.7 percent above the three-month average.

“Investors are trying to weed through what exactly is going on in Ukraine, and the market is drifting back,” Stephen Carl, principal and head equity trader at New York-based Williams Capital Group LP, said in a phone interview. “We have a geopolitical situation that needs to be addressed, and that’s overshadowing everything else in the market.”

Ukrainian government troops attacked an armed convoy that had crossed the border from Russian territory, Andriy Lysenko, a spokesman for the country’s military, told reporters in Kiev. Ukrainian soldiers continue to come under shelling, including rounds fired from Russia, he said.

Weekly Move

The S&P 500 rose 1.2 percent this week as signs of a slowing economy stoked bets central banks will leave interest rates near record lows for longer, overshadowing escalating tensions in Ukraine.

Economic data today showed industrial production advanced 0.4 percent in July, while the New York Fed Empire Manufacturing gauge fell more than estimated and consumer confidenceunexpectedly declined to its lowest level of the year.

Nineteen S&P 500 companies, including Home Depot Inc. and Hewlett Packard Co., are scheduled to release earnings next week. About 76 percent of those that have reported so far this season have beaten analyst estimates for earnings, while 65 percent have exceeded sales projections, data compiled by Bloomberg show.

Nordstrom slid 5.2 percent to $65.11, the lowest since May. The largest U.S. luxury department-store chain reported same-store sales that missed estimates in the most recent quarter.

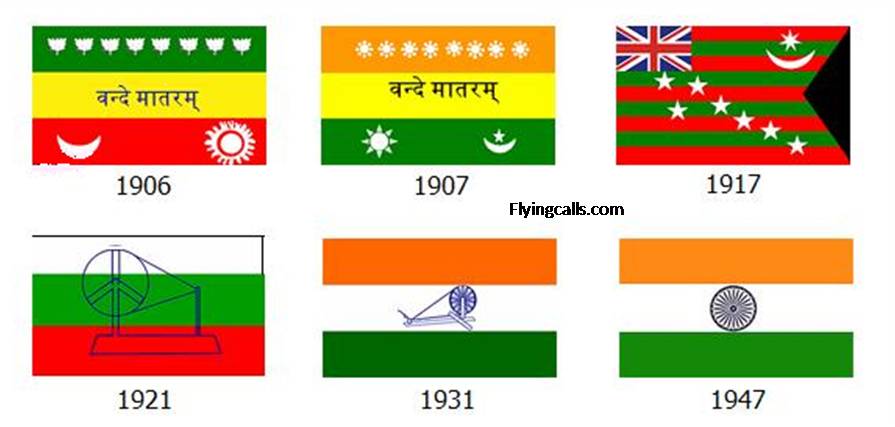

Flyingcalls wishes Happy Independence Day to all Readers, Traders and our Subscribers

Thanks & Regards

Flyingcalls Team / Chennai, Salem (TN)

UN says Iraq humanitarian crisis at highest level

The United Nations has announced its highest level of emergency for the humanitarian crisis in Iraq in the wake of the onslaught by Islamic militants who have overrun much of the country’s north and west and driven out hundreds of thousands from their homes.

The Security Council also said yesterday it was backing a newly nominated premier-designate in the hope that he can swiftly form an “inclusive government” that could counter the insurgent threat, which has plunged Iraq into its worst crisis since the US troop withdrawal in 2011.

Attacks by the Islamic State group and its Sunni militant allies this summer have captured large swaths of land in northern and western Iraq, displaced members of the minority Christian and Yazidi religious communities and threatened Iraqi Kurds in the Kurdish autonomous region in the north.

The UN’s declaration of a “Level 3 Emergency” will trigger additional goods, funds and assets to respond to the needs of the displaced, said UN special representative Nickolay Mladenov, who pointed to the “scale and complexity of the current humanitarian catastrophe.” Tens of thousands of Yazidis fled the Islamic State group’s advance to take refuge in the remote desert Sinjar mountain range.

The US and Iraqi military have dropped food and water supplies, and in recent days Kurds from neighbouring Syria battled to open a corridor to the mountain, allowing some 45,000 to escape.

JSW Steel likely to acquire Welspun Maxsteel for Rs 1000 cr

JSW Steel is likely to sign a Rs 1,000-crore deal to acquire Welspun Maxsteel today. Welspun Maxsteel is situated in the Raigad district of Maharashtra.

JSW Steel is likely to sign a Rs 1,000-crore deal to acquire Welspun Maxsteel today. Welspun Maxsteel is situated in the Raigad district of Maharashtra.

Welspun Corporation holds 99.85 percent in Welspun Maxsteel. With this deal, JSW Steel will acquire the entire shareholding in the company. This deal will also see the takeover Welspun Maxsteel’s debt amounting to Rs 1030 crore by JSW Steel and the company will refinance it. JSW Steel, as of now, has a debt of Rs 32,000 crore on its books.

JSW Steel, however, has said that it does not comment on market speculations and rumours.

This deal will help JSW Steel’s Dolvi plant which is situated in the district and scale up the company’s steel capacity.