22nd Aug’14 Banknifty Future Levels

Banknifty Future closed : 15671

BANKNIFTY future strong hurdle around 15750

Once if stays above the level……….. will move up to 15850 & 16000++

Today’s supports 15520 & 15400 levels

Decline to buying side only!!!

More live market update to our clients only

BANKBARODA Strong breakout level 920

Once if stays above the level

Will move 930 & 942 levels……..

YESBANK Yesterday written Strong Resistance 588 around

Again Headed 589 levels……. then slide 575

Higher stay caution……. If any shorts keep stop-loss 589

Updated : 09.00am / 22nd Aug’14

22nd Aug’14 Hot Calls

DIVISLAB

DIVISLAB Strong Breakout level at 1555

Once If crossover the levels……….

We see Rally up to 1570, 1585 levels

Catch if you can!!!

RECLTD

RECLTD Strong support around 276

Decline to buy with stop of 276………

Expected Target 290 & 295

TITAN

TITAN facing Resistance 373 & 378 levels

Lower level can buy around 360 to 363

Use stop-loss 355 & Hold for Targets

Time frame 1 – 2 days

MRF

MRF now near by Strong Breakout level

Today once if Breaks the level

Rally will be expected upto 500 to 1000 points from our alert!!!

Clients Special call!!!!

GUESS…..

Today’s GUESS………

XXXX BUY ABOVE 188 TARGET 192,195

STOP-LOSS 185

Clients special call……….

( Yesterday’s Guess call : Not activated )

Updated : 08.59am / 22nd Aug’14

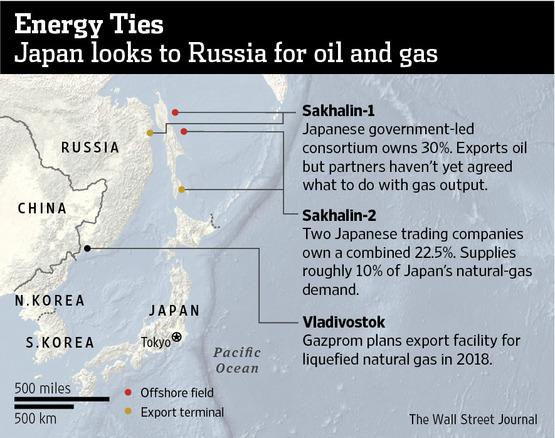

Russia is Japan’s 4th-largest supplier of natural gas, 5th-largest for crude oil

Gold near 2-month low; eyes worst week since May

Gold held near a two-month low on Friday and was headed for its sharpest weekly drop in nearly three months, hurt by strong U.S. economic data and fears that the Federal Reserve could hike interest rates sooner than expected.

Gold held near a two-month low on Friday and was headed for its sharpest weekly drop in nearly three months, hurt by strong U.S. economic data and fears that the Federal Reserve could hike interest rates sooner than expected.

FUNDAMENTALS

Spot gold was little changed at $1,277.69 an ounce by 0030 GMT, near a two-month low of $1,273.06 hit on Thursday, when it fell for a fifth straight session. The metal is down 2.05 percent for the week, its biggest drop since the week ended May 30.

Bullion was hit hard after minutes from the Fed’s July meeting on Wednesday showed policymakers debated whether interest rates should be raised earlier given a surprisingly strong job market recovery. Thursday data showing U.S. home resales raced to a 10-month high in July and the number of Americans filing new claims for jobless benefits fell last week signalled strength in the economy, dulling gold’s appeal as a safe-haven. Investors fear strong data would prompt the Fed to soon raise interest rates.

Higher rates would hurt non-interest bearing assets such as gold. Markets are eyeing Fed Chair Janet Yellen’s speech at the annual gathering of central bankers in Jackson Hole, Wyoming later in the day. CME Group said it has lowered initial margins for COMEX 100 gold futures by 14.8 percent to $5,060 per contract from $5,940. Geopolitical tensions in Ukraine and the Middle East were being watched for any escalation in violence that could prompt safe-haven bids for gold.

MARKET NEWS

The dollar hovered just below its 2014 peak against a basket of major currencies early on Friday, with bulls turning cautious ahead of a speech by Yellen.

Cos tool up for defence orders on Modi’s ‘buy India’ pledge

Some of India’s biggest companies are pouring billions of dollars into manufacturing guns, ships and tanks for the country’s military, buoyed by the new government’s commitment to upgrade its armed forces using domestic factories.

India, the world’s largest arms importer, will spend USD 250 billion in the next decade on kit, analysts estimate, to upgrade its Soviet-era military and narrow the gap with China, which spends USD 120 billion a year on defence. Under the last government, procurement delays and a spate of operational accidents – especially dogging the navy – raised uncomfortable questions over whether India’s armed forces are capable of defending its sea lanes and borders.

Even before his landslide election victory in May, Prime Minister Narendra Modi promised to assert India’s military prowess and meet the security challenge posed by a rising China and long-running tensions with Pakistan. Within weeks of becoming prime minister, he boosted defence spending by 12 percent to around USD 37 billion for the current fiscal year and approved plans to allow more foreign investment into local industry to jump-start production.

Launching a new, Indian-built naval destroyer last week, Modi said: “My government has taken important steps in improving indigenous defence technology … We can guarantee peace if our military is modernised.” This build-up comes as Southeast Asian nations expand their own defence industries, spurred by tensions with China. India, reliant on a state defence industry that often delivers late and over budget, risks being caught flat-footed.

Metals slip on royalty rates hike, China PMI at 3-month low

Metal stocks are reeling under heavy selling pressure as the government has decided to increase royalty rates on minerals. Ferrous stocks like SAIL and Tata Steel slumped 2-3 percent intraday on Thursday after the cabinet hiked royalty rates on iron ore to 15 percent from 10 percent earlier.

MOIL fell around 1 percent as manganese royalty rates are increased to 5 percent from 4.2 percent earlier. Steel stocks are also weak on concerns of weak demand after slower growth in China as its factory sector slowed to a three-month low in August. The HSBC/Markit Flash China Manufacturing Purchasing Managers’ Index (PMI) fell to 50.3 from July’s 18-month high of 51.7.

Meanwhile, the long-awaited government move will significantly swell the annual revenue of states. “Cabinet in-principle approved revision of mineral royalty. There are 55 such items but this excludes coal, lignite and sand for stowing,” Communications and IT Minister Ravi Shankar Prasad said after the Cabinet meeting. As per some estimates, annual revenue collection of mineral-bearing states could swell over 40 percent to around Rs 15,000 crore. Chhattisgarh, Odisha, Jharkhand, Karnataka and Goa are among the 11 mineral-rich states.

The Cabinet proposal had wanted royalty on bauxite to be hiked to 0.6 percent from 0.5 percent now. There were also plans to hike the rate for manganese to 5 percent from 4.2 percent. The rates of royalty, revised in every three years, for major minerals excluding coal, lignite and sand for stowing were last revised in August, 2009.

It is charged on ad valorem basis, depending on increase/decrease in mineral prices. The current proposals are based on the recommendations of a 17-member study panel set up by the UPA-II regime in 2011. Royalty is a tax levied by government on miners in lieu of transfer of ownership rights of mines. While the government views it as a source of revenue, industrialists look at it as part of production costs.

YESBANK Chart Update

Above is Yesbank Intraday chart

Now trading near by Two months high…. currently trading 586

Facing Strong Resistance around 588

If crosses 588 and close above the levels………

Next Target 602 and 615…….

Updated : 11.24am / 21st Aug’14

M for Money……. Auropharma 800ce Bought 14….. Now Booked Profit at 22

M for Money…….. O for Options

Yes, Minted Money Every Day……….

Yesterday Recommend AUROPHARMA 800ce at 14

Today Morning Booked Profit at 22……… Rs 8 x 500 : Rs 4000 Profit per Lot!!!

U know recent our all options Rocked

Like….. KOTAKBANK 980ce, Tatamotors 490ce, Icicibank 1520ce,Adani 480ce

Updated : 10.14am / 21st Aug’14