Nifty Future noon update…… Crucial support around 8085

Nifty Future opened gap down and made a low of 8085

Now trading at 8130……… Recovered 40 points from intraday low.

Already our clients booked 60 points profits!!!

Nifty Future consider strong crucial support Today’s low 8085

Once if breaks 8085 and trade below 15 minutes…….. Panic selling will be expected

NF Facing Resistance 8150 & 8180

If rise………. Sell Sell Sell

Updated : 01.31 PM / 16th June 2016

Nifty Future cracked vertically from 8150 to 8085!!! Booked 60 points profit

Today our first alert at 09.58 AM

“SELL NIFTY FUT AT 8150 SL 8180 TARGET 8100 8080 CMP 8150”

After our alert sustained few minutes at 8150…….. Then melting

Now achieved & Booked Profit at 8090!!!………… 60 points profits!!

Again if rise………… Sell Sell Sell………….. Nothing else

Updated : 12.08 PM / 16th June 2016

Nikkei melting 485.44 at 15434.14 (-3.05%)

Updated : 11.37 AM / 16th June 2016

VEDL Blasted after our buying alert…….. 118.50 to 122.30!!!

VEDL now @ 118.50……….. Buy buy buy!!!! Rally will be expected https://t.co/yZppIyjYol

— flying calls (@flyingcalls) June 16, 2016

VEDL now @ 122. Book Part Profit now bought at 118.50 https://t.co/yZppIyjYol

— flying calls (@flyingcalls) June 16, 2016

16th June 2016 Nifty Future Update

Nifty Future last close : 8221.35

Nifty Future last close : 8221.35

Yesterday Nifty Future was bounced from lower level

NF made a low of 8105.10 (flashed) & made a high of 8232.40……. Then closes at 8221.35

We sent selling alert @ 8170 and tight stop 8195 triggered……. 25 pts stop loss

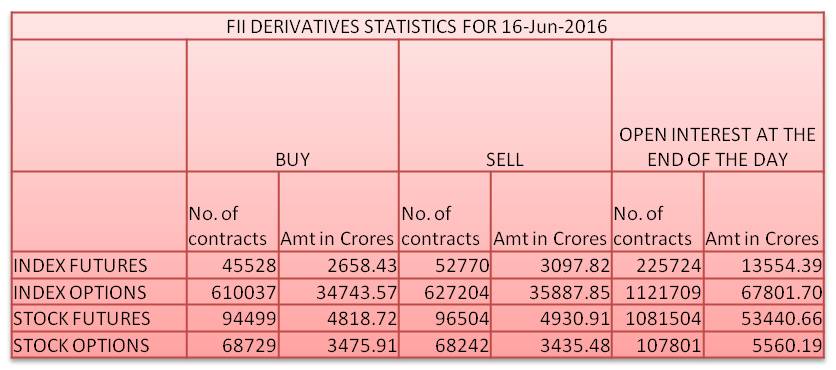

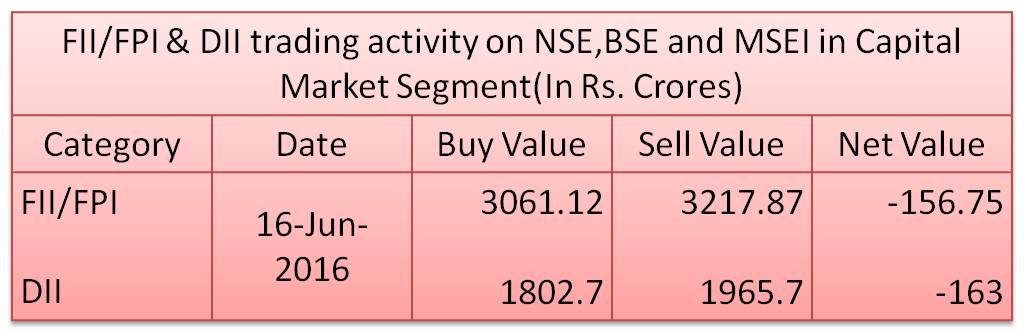

FII’s net sell 638 crore in Index Future and net sell 108 crore in cash segment

Today Nifty Future consider resistance 8230 & 8260

If stays above the level……… We see more rally up to ?

Today’s Supports 8200 & 8180

Once if breaks 8180 and stays below 15 minutes……… Finding next support 8150

Below 8150……………………..???

Live Market update, Entry and Exit levels send to our clients only

Updated : 08.34 AM / 16th June 2016

16th June 2016 Banknifty Future levels (Clients special)

Today’s Banknifty Future supports & resistances, Entry & Exit

Everything send to our clients during market hours!!

Updated : 08.31 AM / 16th June 2016

16th June 2016 Hot Calls

VEDL

( Last Close: 119.70 )

VEDL Looks very strong & Told last week every decline to buy

Aagin can buy around 118-119

Expected Rally 123, 125 and 128

HINDPETRO

( Last Close : 919 )

HINDPETRO sharp bounce back from 12 days low

Favor for bulls……….. Can buy around 910-915

Expected Rally 930 & 935

JETAIRWAYS

(Last Close : 561.35 )

JETAIRWAYS after aviation policy seen selling pressure!!

Below 565………. We see 555 & 545 levels

If rise sell with stop of 580

MARUTI

( Last Close : 4209.60 )

MARUTI now near by strong breakout level

Once if breaks & trade above the level

Rally will be expected up-to ??

Which level will breaks ??

Clients special call

Updated : 08.20 AM / 16th June 2016

Federal Reserve System left unchanged the interest

Release Date: June 15, 2016

The Federal Reserve has made the following decisions to implement the monetary policy stance announced by the Federal Open Market Committee in its statement on June 15, 2016:

- The Board of Governors of the Federal Reserve System left unchanged the interest rate paid on required and excess reserve balances at 0.50 percent.

- As part of its policy decision, the Federal Open Market Committee voted to authorize and direct the Open Market Desk at the Federal Reserve Bank of New York, until instructed otherwise, to execute transactions in the System Open Market Account in accordance with the following domestic policy directive:

“Effective June 16, 2016, the Federal Open Market Committee directs the Desk to undertake open market operations as necessary to maintain the federal funds rate in a target range of 1/4 to 1/2 percent, including overnight reverse repurchase operations (and reverse repurchase operations with maturities of more than one day when necessary to accommodate weekend, holiday, or similar trading conventions) at an offering rate of 0.25 percent, in amounts limited only by the value of Treasury securities held outright in the System Open Market Account that are available for such operations and by a per-counterparty limit of $30 billion per day.

The Committee directs the Desk to continue rolling over maturing Treasury securities at auction and to continue reinvesting principal payments on all agency debt and agency mortgage-backed securities in agency mortgage-backed securities. The Committee also directs the Desk to engage in dollar roll and coupon swap transactions as necessary to facilitate settlement of the Federal Reserve’s agency mortgage-backed securities transactions.”

More information regarding open market operations may be found on the Federal Reserve Bank of New York’s website.

- The Board of Governors of the Federal Reserve System took no action to change the discount rate (the primary credit rate), which remains at 1.00 percent.

This information will be updated as appropriate to reflect decisions of the Federal Open Market Committee or the Board of Governors regarding details of the Federal Reserve’s operational tools and approach used to implement monetary policy.

FOMC Meeting Statement: PDF File click below link

https://www.federalreserve.gov/monetarypolicy/files/monetary20160615a1.pdf