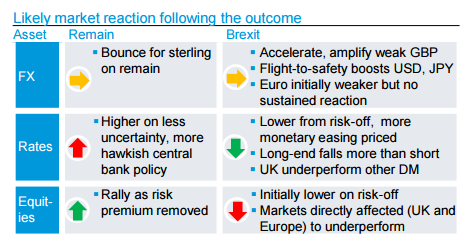

The predicted market reaction is a reflection of what investors already have seen in the run-up to the vote. The pound GBPUSD, +0.0887% which is seen as one of the best proxies of Brexit fears, rallied to a three-week high on Monday after polls out over the weekend showed a resurgence for the “remain” camp. Sterling continued its march higher on Tuesday even if polls out on Monday were mixed.

“Markets in the last few weeks have been driven almost exclusively by Brexit risk,” the Deutsche Bank analysts said in the note.

Other strategists agree that a “leave” vote would trigger a selloff in the pound and stocks. Goldman Sachs said last week investors should brace for an 11% drop in the U.K. currency in the event of a Brexit. Citigroup is calling the pound down 15%. And on Tuesday, Eric Lascelles, chief economist at RBC Global Asset Management, warned of a sharp pullback in equities.

“In the unlikely event of a ‘leave’ vote, the theoretical short-term stock market reaction could be as much as a 10% decline while the long-term response would logically be somewhat smaller than this, at about a 2ppt decline (the amount of foregone future earnings),” he said in a note.

Updated : 01.57 PM / 22nd June 2016