Nifty last close: 19889.70 (+0.48%)

After two days of mildly negative close, the Indian benchmark indices made a strong close on Nov 28

Nifty was spiked more than 80 points in the last 1 hour

Finally, Nifty was up 95.00 points or 0.48 percent at 19,889.70

Sensex was up 204.16 points or 0.31 percent at 66,174.20

The biggest gainers on the Nifty were Adani Enterprises, Adani Ports, Tata Motors

While losers were Eicher Motors, Apollo Hospitals, ICICI Bank, ITC and Cipla

On the sectoral front, power and oil & gas indices added 3 percent each

While metal, auto and PSU Bank indices rose 1 percent each

midcap index was up 0.3 percent and the smallcap index ended on a flat note

TCS share buyback to start on December 1, close on December 7

Home First Finance promoter sells 3.92% stake via open market on November 23

Investing genius Charlie Munger, Warren Buffett’s trusted advisor, passes away at 99

Who would have marked his 100th birthday on New Year’s Day

Despite possessing a fortune estimated at $2.3 billion in early 2023

IREDA to debut on November 29

Alipay likely to sell 3.4% stake in Zomato via block deal

A total of 29.6 crore shares will be sold by Alipay, at a price of Rs 111.28 apiece

Foreign institutional investors bought shares worth Rs 783.82 crore

while domestic institutional investors purchased Rs 1,324.98 crore worth of stocks on November 28

US markets ended higher on Nov 28

Dow gained 0.24%, Nasdaq added 0.29% and S&P500 ended flat

US 10-year yield falls to 4.3%

As invetors mull optimistic comments from Fed official

Crude recoveres and Brent crude at $82/bbl

The Dollar index traded 0.06 percent lower in futures at 102.86

Spot gold last gained 1.4 percent to $2,041.93 per ounce

Asian markets mixed in early trade

GiftNifty indicates a positive opening for the index

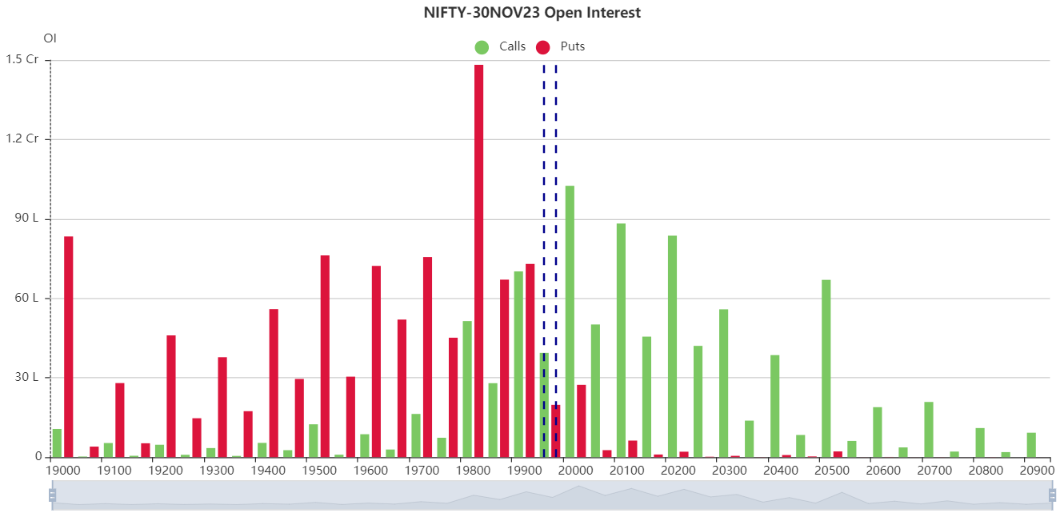

Nifty is facing a intraday resistance 19920 and 19955

If stays above 19955 will try to move 20030 and 20100

On other hand, Nifty considering a supports 19860 and 19835

Below 19835 will try to check 19790

If declines can add

Updated: 08.32 am / 29th Nov 2023