Nifty last close: 16951.70 (-0.2%)

On Tuesday, Nifty was seen selling pressure and ended 0.2% lower

Nifty was opened 17030 then fell to 16915 and ended 16950

Sensex down 40.14 points or 0.07 percent to end at 57,613.72

Nifty down 34 points or 0.20 percent at 16,951.70

Adani group of stocks triggered the market and seen huge selling pressure

Midcap index declined 0.4 percent and the smallcap index fell 0.8%

Nifty auto index declined 1%, IT 0.88%, infra and metal 0.7% each

While infra and energy down 0.5 percent each

However, some buying is seen in the banking names

Vedanta announces fifth interim dividend of Rs 20.50 per share

FIIs net bought 1531 crore while DIIs net sold 156 crore

US future higher following a close with minor cuts for the cash market

Dow down 0.12%, S&P500 fell 0.16% and Nasdaq declined 0.45%

US consumer confidence ticks up in March. Index rose to 104.2

The consumer confidence remains below 2022’s average level of 104.50

Dollar index sustained around 102.40

Gold prices rose on Tuesday. Spot gold gained 0.3% to $1962/oz

Brent crude settled around $79/bbl

Asian markets largely higher

Hangseng up more than 2% and Japan’s Nikkei up 0.4%

SGXNifty indicates higher opening

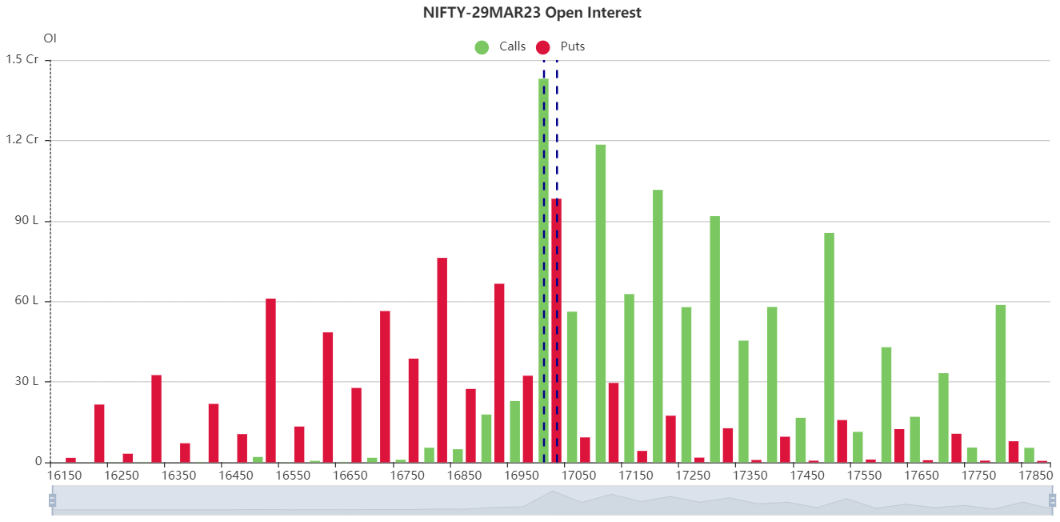

As per open interest 17000CE and 17000PE was seen highest on 28 March closing basis

However, Nifty is facing a intraday resistance 16980, 17000 and 17035

If stays above 17035 will try to move 17100

On other side, Nifty can be considered as supports as 16940, 16910 and 16875

Below 16875 finding a next support around 16830

Updated: 08.35 am / 29th March 2023