Nifty last close: 21951.15 (-1.1%)

The Indian equity benchmarks closed more than a percent lower on February 28 amid selling across the sectors

Nifty was opened 22200 then slipped to 21900

Nifty slipped to 21,951.20 down 247.10 points, or 1.11 percent, its biggest drop in five weeks

The Sensex ended 790.34 points, or 1.08 percent, lower at 72,304.88 after hitting a low of 72,222.29

Biggest Nifty losers included Power Grid Corporation, Apollo Hospitals, Eicher Motors

while gainers were HUL, Infosys, TCS and Bharti Airtel

All the sectoral indices ended in the red with auto, oil & gas, power and realty. down 2 percent each

Midcap and smallcap indices fell 2 percent each

RIL announces Rs 70,352 crore JV with Disney to merge streaming, TV assets in India

Sebi issues confirmatory order on Brightcom Group; suggests further examination by ED

Foreign institutional investors (FIIs) net sold shares worth Rs 1,879.23 crore

while domestic institutional investors (DIIs) bought Rs 1,827.45 crore worth of stocks on February 28

US markets marginally down on Feb 28

Dow and S&P500 ended flat note and Nasdaq slipped to 0.55%

US fourth-quarter economic growth revised slightly lower

US 10-year yield near 4.3%

Gols prices rise above $2035/oz

Brent crude futures settled 3 cents higher, or up 0.04 percent at $83.68 a barrel

Bitcoin rallied above $63000 for the first time in more than 2 years

Asian markets were set to mixed in early morning

Nikkei down 0.65% and Hangseng up 0.80%

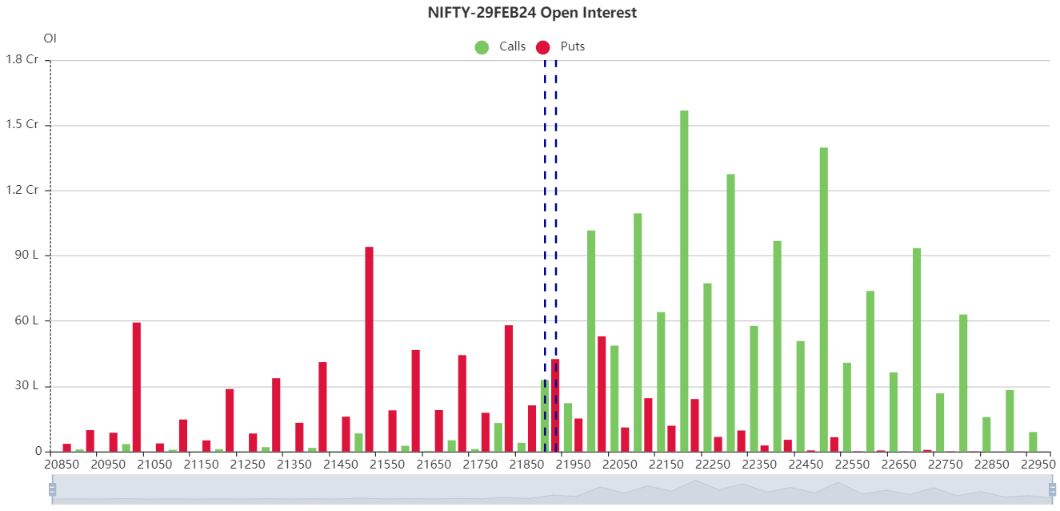

Nifty is facing a intraday resistance 22000 and 22040

If stays above 22040 will try to move 22100

On other side, Nifty considering a supports 21900 and 21865

Below 21865 will try to check 21800

Updated: 08.57 am / 29th Feb 2024