Nifty last close: 22004.70 (-0.42%)

The markets broke three-day winning momentum and ended lower in the volatile session on March 26

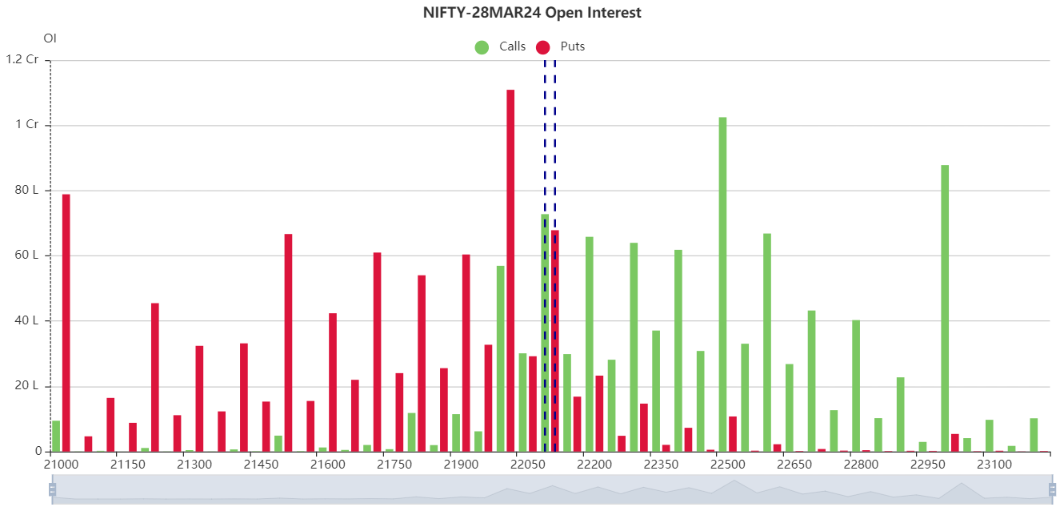

Nifty was opened around 22000 and seen strong consolidation around 22000-22050

Finally, Nifty was down 92.10 points, or 0.42 percent, at 22,004.70

Sensex was down 361.64 points, or 0.5 percent, at 72,470.30

Bajaj Finance, Hindalco Industries, Britannia Industries, Adani Ports and L&T were among the top gainers

while losers were Power Grid Corporation, Eicher Motors, Bharti Airtel, Kotak Mahindra Bank and Wipro

On the sectoral front, Bank and Information Technology indices were down 0.5 percent each

while Capital Goods, Realty, Oil & Gas, Metal indices gained 0.5-1 percent

India’s current account deficit narrows to $10.5 billion in October-December

Foreign institutional investors (FIIs) net bought shares worth Rs 10.13 crore

while domestic institutional investors (DIIs) purchased Rs 5,024.36 crore worth of stocks on March 26

US markets erase opening gains and ended day’s low on March 26

Dow ended almost flat, Nasdaq down 0.42% and S&P500 fell 0.28%

US VIX settled around 13.2

Nvidia fell almost 4% from record high

Trump Media and Tech group jumps 25% on its stock market debut

Crude falls and settled around $86/bbl

US 10-year yield slips from 4.3% to 4.2%

Gold hits record high $2220/oz

Asian markets were set to mixed opening in the early morning

Nikkei up 1% and Hangseng down 0.6%

GiftNifty indicating a flat opening for the index

Nifty is facing a intraday resistance 22035 and 22060

If stays above 22060 will try to move 22100

On flip side, Nifty considering a supports around 21990 and 21970

Below 21970 finding a next support around 21930

Updated: 08.45 am / 27th March 2024