BankniftyFuture last close: 36205.35 (-0.8%)

On Wednesday, BankniftyFuture was seen huge selling pressure

BNF was opened 36820 and went to 36858 then melted up to 36113.30

PSU and Private banks seen huge selling pressure

SBIN did not well and slipped 2%

Volatility index sustained around 24-25

Option premium ended too high

ATM straddle ended around 625 (CE + PE)

BankniftyFuture formed a bearish candle on Wednesday’s trade

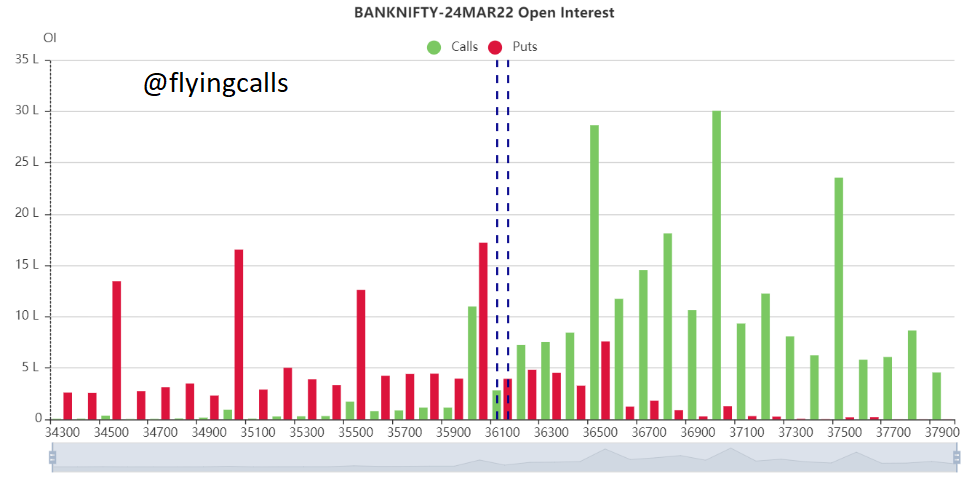

As per Open Interest, 36500CE added more OI and followed by 37000CE

There is no significant OI on PE sides which is indicating sell on rise

BankniftyFuture is facing a intraday resistance 36350, 36450 and 36600

Above resistance are crucial for today’s trade!!

If comes above levels can sell with a stop of every resistance zone!!

On other side, BNF can be considered as supports as 36000 and 35900

Below 35900 will try to check 35700 and 35500

Updated: 08.27 am / 24th March 2022