Nifty last close: 17151.90 (+0.3%)

Indian equity indices ended higher for the second consecutive session

Nifty was opened 17170 and was seen very range in the 50 points only

Sensex was up 139.91 points or 0.24 percent at 58,214.59

Nifty was up 44.40 points or 0.26 percent at 17,151.90

On the sectoral front, the pharma added 1% and the PSU Bank index was up 0.8%

Midcap index ended on a flat note, while smallcap index rose 0.5%

FIIs net bought 62 crore while DIIs net bought 383 crore

U.S. FED INTREST RATE DECISION ACTUAL: 5.00% VS 4.75% PREVIOUS; EST 5.00%

FED: WE WILL KEEP REDUCING THE BALANCE SHEET AS PLANNED

FED’S MEDIAN VIEW OF FED FUNDS RATE AT END-2024 4.3% (PREV 4.1%)

EURO RISES AGAINST DOLLAR AFTER FED RATE DECISION, LAST UP 0.66% AT 1.084

FED’S MEDIAN VIEW OF FED FUNDS RATE AT END-2025 3.1% (PREV 3.1%)

FED POLICYMAKERS: SLOWER GDP GROWTH IN 2023, LOWER UNEMPLOYMENT

US Future higher following a 25 bps rate hike by Fed

US markets ends fall on Wednesday

Frontline indices fell 1.5%

Sharp fall regional bank stocks & Treasury Secy comments weighted on market

US not currently working on Blanket Insurance for bank deposits

US 10-year yield slips to 3.47%

Crude rises 2% to post a one week high on Fed meet outcome

Gold prices above $1970/oz

Hindenburg tweets “Another Big One”

Asian markets lower in early trade

SGXNifty indicates a negative opening for the index

Likely to witness volatile will be expected during the day

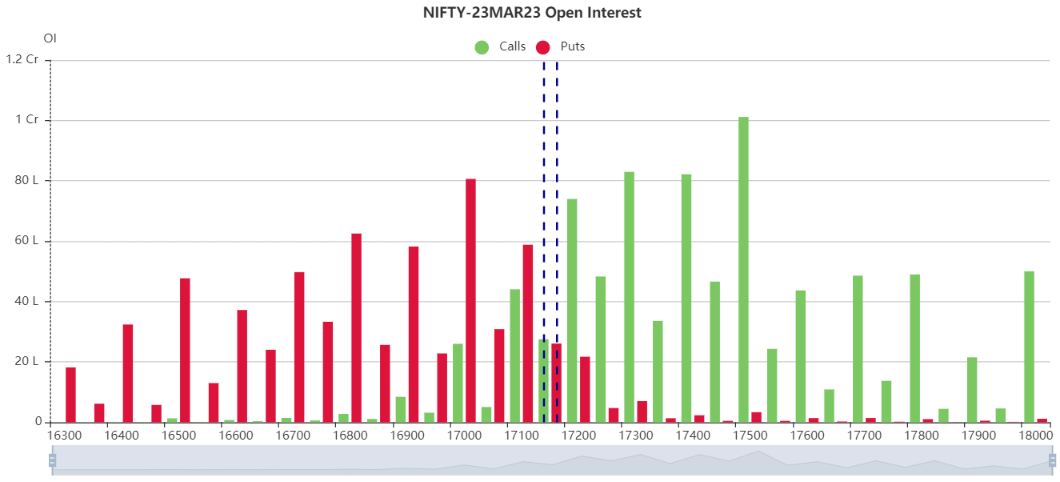

However, Nifty is facing a intraday resistance 17170, 17185 and 17225

If stays above 17225…. expecting more rally

On other side, Nifty can be considered as supports as 17130, 17115 and 17090

Below 17090 will try to check 17030

Updated:08.48 am / 23rd March 2023