NiftyFuture last close: 17362.80 (+1.2%)

On Tuesday, NiftyFuture was turned V shape recovery and ended gain 1.2% gain

NiftyFuture was opened 17140 and fell up to 17051 then seen huge short covering up to 17383

NF was bounced more than 300 points from day’s low

Bank index gained more than 1000 points from day’s low

Volatility index fell 4% and settled around 24-25

Option premium seems high despite VIX sustained around 24

Petrol and Diesel retail prices raised by 80 paise in 2nd straight hike

Oil edges lower as EU looks less likely to ban Russian oil

Bitcoin climbs to highest in almost three weeks

FIIs net bought 384 crore while DIIs net sold 602 crore on March 23

Five stocks under F&O ban: Balramchin, Deltacorp, GNFC, Ibullhsgfin and Suntv

US markets ended higher on March 22

Dow gained 0.75%, S&P 500 gained 1.1% and Nasdaq added nearly 2%

Apple, Microsoft, Amazon and Meta rallied and helped to lift the Nasdaq index

Asian markets led gains in Wednesday early trade

Nikkei rose 2.5% and Topix index advanced 1.90%

SGXNifty indicates a positive opening for the index

NiftyFuture formed a bullish candle on Tuesday

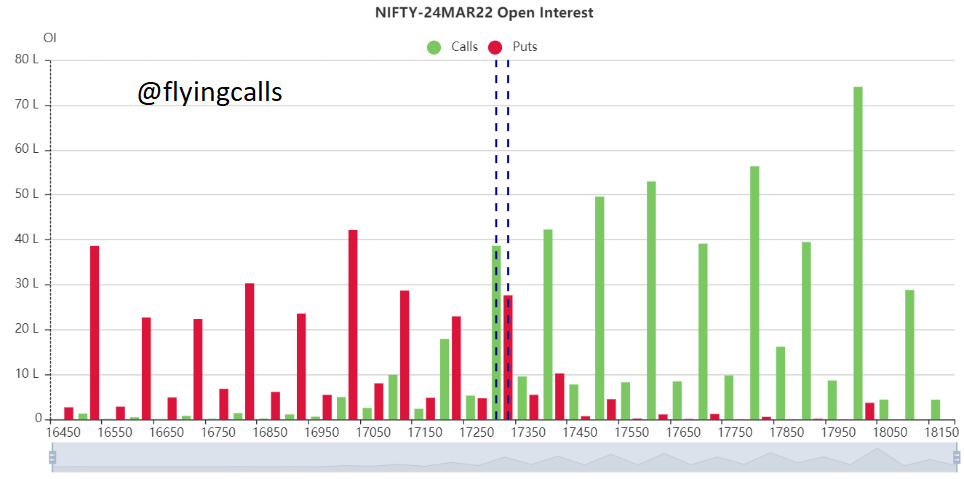

As per OI, 17500CE, 17600cE added more OI and PE side 17000PE added more OI

However, NiftyFuture is facing a intraday resistance 17400 and 17455

Once if breaks and manages above 17455 will try to check 17525

On other side, NF can be considered as supports as 17330, 17300 and 17260

Updated: 08.30 am / 23rd March 2022