BankniftyFuture last close: 36093.25 (-0.9%)

On Monday, BankniftyFuture was seen selling pressure and index declined around 1%

BNF was opened 36500 and gradually slipped up to 35940

PSU Bank index not well and slipped 1.5%

SBIN declined around 3%

Private banks also not well on March 21

Icicibank and Hdfcbank seen selling pressure

Volatility index spiked 8%

Option premium did not fall and seems higher rate

ATM straddle ended around (CE + PE) ended around 1030

BankniftyFuture formed a bearish candle on March 21

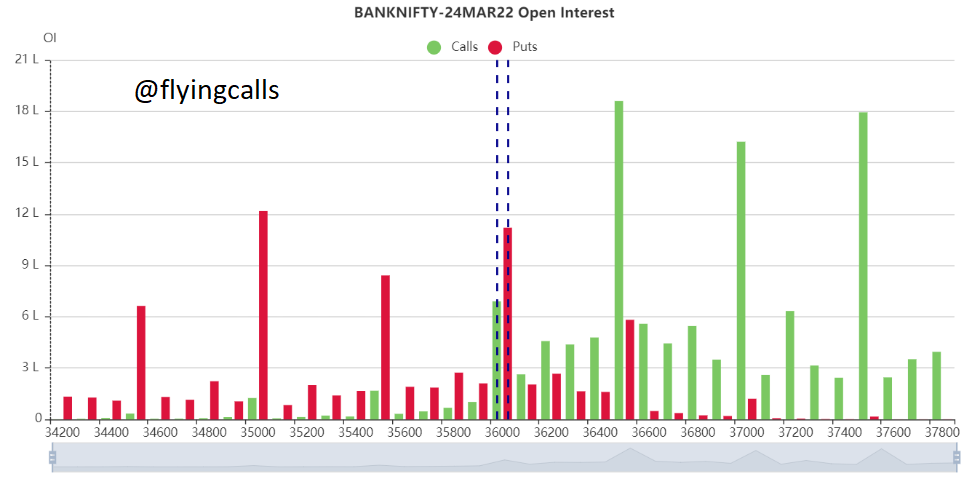

As per Open Interest, 36500CE was added more OI and there is no significant OI on PE sides

However, BankniftyFuture is facing a intraday resistance 36200, 36300 and 36500

Above 2nd and 3rd resistance are hurdle for today’s trade

On other side, BNF can be considered as supports as 35900-36000

Below 35900, will try to check 35730 and 35500

Updated: 08.23 am/ 22nd March 2022