Nifty last close: 21839.10 (+0.1%)

The market closed with moderate gains on March 20 after a choppy session

Nifty was opened 21850 then fell to 21700 again bounced to 21900

Finally, Nifty was up 21.60 points or 0.10 percent at 21,839.10

Sensex was up 89.64 points or 0.12 percent at 72,101.69

Top gainers on the Nifty included Eicher Motors, Maruti Suzuki, Power Grid

while losers were Tata Steel, Tata Consumer Products, Tata Motors, Axis Bank

Among sectors, auto, FMCG, realty, oil & gas, power were up 0.5-1 percent each

while the metal index was down nearly a percent

Mid and smallcap indices ended flat

Foreign institutional investors (FIIs) net sold shares worth Rs 2,599.19 crore

while domestic institutional investors (DIIs) bought Rs 2,667.52 crore worth of stocks on March 20

Wall Street’s main stock indexes closed higher on Wednesday

Fed leaves rates unchanged for 5th straight meeting and maintains 5.5%

Fed continues to expect 3 interest rate cuts in 2024

Only 3 further cuts next year (down from 4 previously) & another 3 cuts in 2026

Core PCE inflation forecast for 2024 raised to 2.6%

Fed says inflation “has eased but remains elevated”

Fed does not expect rate cuts until “greater confidence” inflation is moving to 2%

Dow gained 1%, Nasdaq rallied 1.25% and S&P500 added 0.89%

US VIX ended 13 down 5.5%

S&P500 closes above 5200 for the first time on a Dovish fed

US 10-year yield falls near 4.25%

Crude falls below $87/bbl

Gold prices rise above $2200/oz

Asian markets opens higher

Nikkei hits record high up nearly 2%

GiftNifty indicates a gap up opening for the index

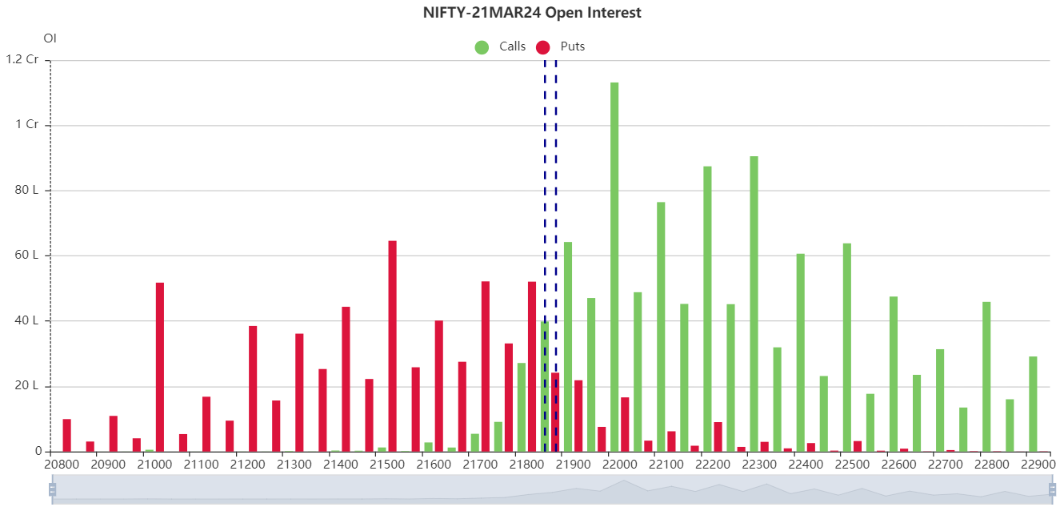

Nifty is facing a intraday resistance 21900 and 21960

If stays above 21960 will try to move 22050

On flip side, Nifty considering a supports 21800 and 21760

Below 21760 finding a next support around 21700

Updated: 08.43 am / 21st March 2024