Nifty last close: 16988.40 (-0.7%)

On Monday, Nifty was seen huge selling pressure in the first half fell more than 250 points

Nifty was recovered almost 170 points in the second half

Finally, Sensex closed points, or 0.62 percent, lower at 57,628.95

Nifty was down 111.60 points, or 0.65 percent, at 16,988.40

All sectoral indices ended in the red

Realty, capital goods, IT, metal and PSU bank were down 1-2%

Midcap and smallcap indices shed 1 percent each

VIX ended around 16.20O

NPAs of public sector banks decline to 5.53% in Dec 2022-Finance Ministry

Bad loans of state run declined from a peak of 14.6% in March 2018 to 5.53% in Dec 2022

FIIs net sold 2545 crore while DIIs net bought 2876 crore on March 20

GDP to grow at 7% and Inflation set to moderate : Finmin Report

Gold drops from one year peak

Spot gold dipped 0.8% to $1972/oz after hitting $2000/oz

US markets ends with gains on Monday

Frontline indices rise up 1% to 1.3%

US VIX down 5% to 24.13

First Repulic bank continues with the sell-off and slides 47% during the day

US 10-year yield rises to 3.49% ahead of 2-day FOMC meet start today

Bitcoin tops to $28000 for the first time in 9 months on bank crisis

Crude rebounds after break below $70/bbl

Asian markets higher in early trade

Hangseng rises 0.7% and Kospi up 0.5%

SGXNifty indicates a gap up opening for the index

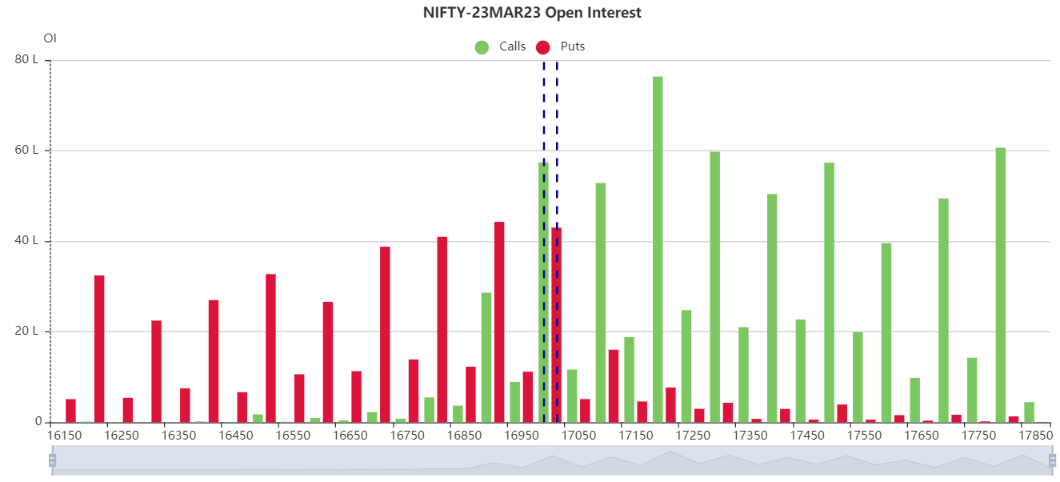

Today Nifty is facing a intraday resistance 17030, 17055 and 17120

Once if breaks and manages above 17120 will try to move 17200

On flip side, Nifty can be considered as supports as 16950, 16920 and 16850

Below 16850…. expecting more pain

Updated: 08.47 am / 21st March 2023