NiftyFuture last close: 35966.75 (+0.6%)

Positive sentiments continued to prevail in the Indian equity markets

Indian equity market higher for the fourth consecutive day on July 20

On Wednesday, NiftyFuture was opened gap up and ended 1% higher

NF was opened 16530 and went to 16577 then dropped to 16492

Sensex was up 629.91 points or 1.15 percent at 55,397.53

Nifty closed higher by 180.3 points or 1.10 percent at 16,520.85

Nifty IT index led the pack of gainers as it gained 2.93

FMCG and Metals index added more than a percent each

Auto and Realty were the two losers as they lost close to 0.2% each

Indusindbank announced their earning report on marginally higher

Wipro announced below expectation result and US ADR down 2.5%

VIX broken 17 level first time since Jan 2022

Singapore GRM fell to $3.9/bbl – the lowest since December 1, 2021

Q1FY23 Average Prices were around $21.4/bbl, Negative for Reliance, MRPL and ONGC

Brent crude sustained around $105 a barrel

Market uptrend adds more than Rs 7 lakh crore in wealth to investors

Today’s result stocks CSBBank, RBLBank, Canfinhome, GSFC, Hindzinc, SRF and PVR

FIIs net bought 1780 crore while DIIS net sold 230 crore

Deltacorp are under F&O ban on July 21

US Future lower after a close in the green for cash segment

US markets ended higher levels in over a month

Dow gained 47 points while Nasdaq added 185 points

Asian markets were set to opened marginally lower on Thursday early trade

SGXNifty indicates a almost flat opening for the day

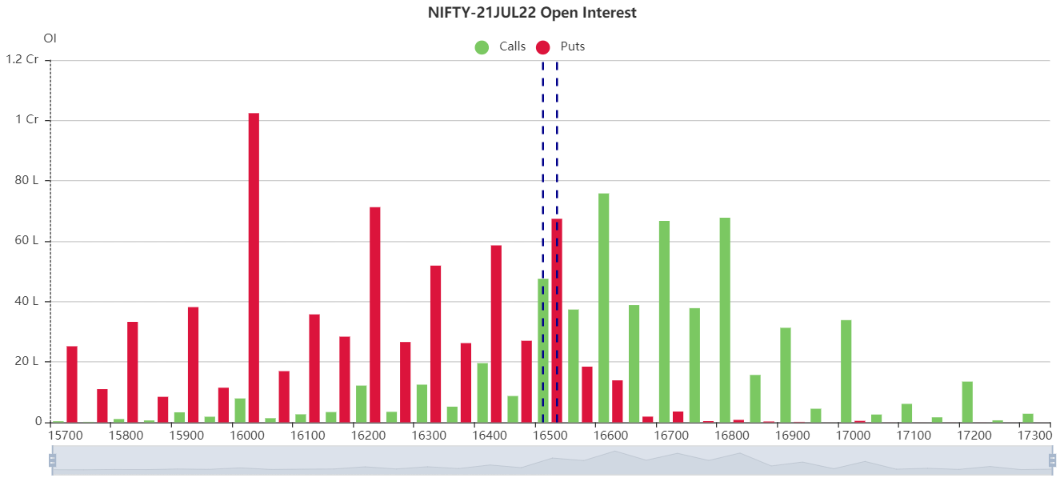

As per open interest 16600CE added more OI and 16500CE and PE seems equal OI

PE side there is no significant OI

However, NF is facing a intraday resistance 16535, 16570 and 16600

Above levels is a stiff resistance for today’s trade

On flip side, NF can be considered as supports as 16500 and 16470

Below 16470 will try to check 16430 and 14390

Updated: 08.39am / 21st July 2022