NiftyFuture last close: 15766.25 (-2.8%)

On Monday, What a Scary and Black Monday

NiftyFuture was declined more than 400 points due to weak global cues

NF was opened gap down around 380 points at 15900 then fell to 15673.50 and ended 15766

Sensex was down 1,456.74 points, or 2.68 percent, at 52,846.70

Nifty was down 427.40 points, or 2.64 percent, at 15,774.40

All the sectoral indices ended in the red

Nifty bank, auto, IT, metal and PSU bank falling 2-4% each

Midcap shed 2.7 percent and the smallcap index lost 3 percent

The Indian rupee ended 19 paise lower at 78.03 to a dollar against June 10’s close of 77.84

RBL Bank declined more than 20% and marked all time low

All front line stocks fell 2% to 5%

India retail inflation for May matches at 7.04% vs 7.79%

VIX shot up to 15% at 21.50

Option premium didn’t fall due to high VIX

US markets tumbled on Monday

The S&P500 confirming it is an in a Bear Market

Fears grow that the expected aggressive interest rate hikes by the FED would push the economy in a Recession

US VIX shot up to 25% at 34

Dow Jones down 878 points, Nasdaq slipped 530 points and S&P500 dropped 151 points

Dow Joned was broken recent low 30600 and closed below the level

European markets fell 1.5% to 3%

Asian markets were set to lower opening on Tuesday early trade

US Future marginally higher at 80 points

Crude prices marginally higher around $122 a barrel

NiftyFuture has formed a big bearish candle on 13 June

NF was took support around 15683 which was March 8 low but SGXNifty indicates below the level

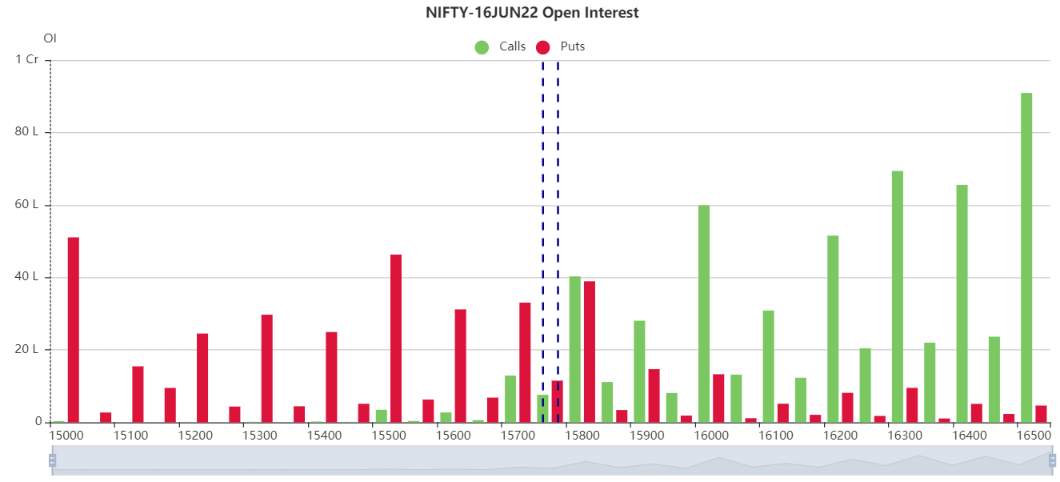

However, NiftyFuture can be considered as support as 15675 which was yesterday’s low

If breaks and manages below 15675 will try to check 15620 and 15500 levels

On other side, NF is facing a intraday resistance 15840, 15920 and 16000

Stay caution at higher levels

Updated: 07.30 am / 14th June 2022