Nifty last close: 22335.70

In yet another volatile session on March 12, the Indian benchmark indices ended on a mixed note

Nifty was opened 22350 went to 22450 then slipped to 22250

Finally, Nifty gained three points or 0.01 percent at 22,335.70

Sensex rising 165.32 points or 0.22 percent at 73,667.96

Top gainers on the Nifty included HDFC Bank, TCS, LTIMindtree, Maruti Suzuki and Infosys

while losers were Adani Enterprises, Cipla, Grasim Industries, Adani Ports and SBI

On the sectoral front, except IT all other indices ended in the red

Realty index down nearly 3.5 percent, PSU Bank and Media indices down two percent each

while capital goods, FMCG, healthcare, metal and power indices fell one percent each

Midcap index was down 1.3 percent and Smallcap index shed two percent

Nifty Smallcap index down 10% from peak; Over 30 stocks see double-digit losses

India’s February CPI inflation at 5.09%, core inflation drops further to 3.3%

India’s January IIP growth at 3.8% versus 4.2% in December

BAT to sell 3.5% ITC stake for Rs 16,775 crore; offers shares at 5% discount

SEBI asks Vedanta India to pay Cairn UK Holdings Rs 77.62 cr for late dividend payout

Foreign institutional investors (FIIs) net bought shares worth Rs 73.12 crore

while domestic institutional investors (DIIs) purchased Rs 2,358.18 crore worth of stocks on March 12

US markets ended higher on March 12

Dow gained 0.61%, Nasdaq rallied 1.54% and S&P500 added 1.12%

US VIX down around 9% to 13.90

US Feb inflation rate 0.4% MoM vs estimate of 0.3%

US 10-year yield slightly higher to 4.15%

Gold falls 1% from record high and ended $2155/oz

Brent futures for May delivery were up 36 cents, or 0.44 percent, at $82.28 a barrel

Asian markets were set to mixed opening in the early session

Nikkei down 0.4% and Hangseng up 0.2%

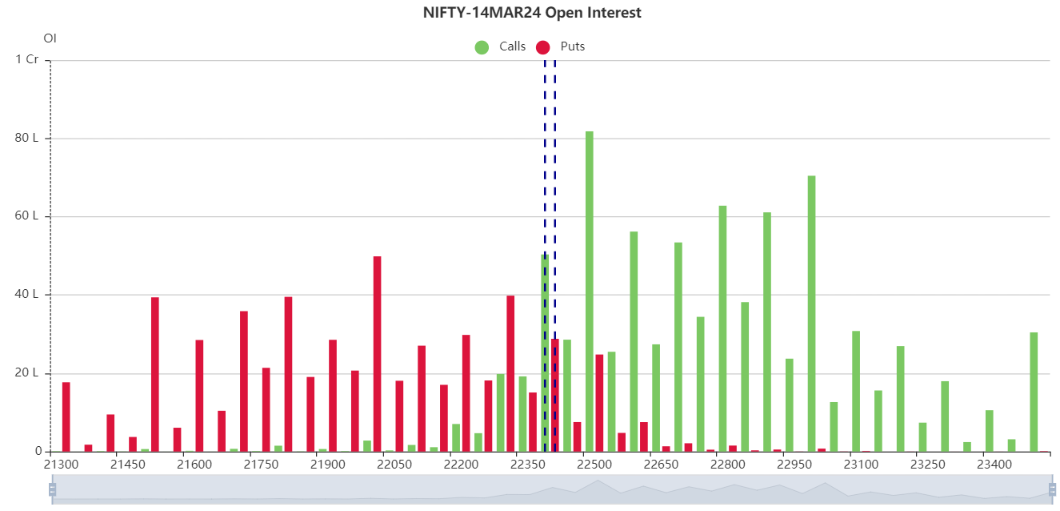

Today’s Nifty supports, resistance levels and open interest data will be sharing to my free telegram channel

Free telegram channel link is https://t.me/FlyingcallsArjun

Updated: 08.42 am / 13th March 2024