Last close: 17557.75 (+0.8%)

On Monday, NiftyFuture was shined and rallied around 1%

NiftyFuture was opened 17410 and went to gradually up to 17584

The finaly tally was Sensex rallied 465 points and Nifty50 rose 128 points

Banknifty shot up to 1.2%

Smallcap and Midcap stocks marginally gained

Hdfc twins was contributed more than 40 points to lift the index

Reliance and Bajajfinsv gained and supported to the index

VIX sustained around 19

Brent crude sustained around $96

Today’s result stocks are Coalindia, Eicher motor, Hindalco, Irctc, Tataconsumer and Gleanmark

FIIs net bought 1449 crore while DIIs net sold 140 crore

China CPI inflation up 2.7% vs poll of 2.9%

US future trading with minor gains after a closes in the red of cash segment

US markets ended lower for third straight session

Semiconductor chip stocks remain under pressure and Nasdaq down 1.2%

European markets ended largely lower

Asian markets were set to lower for Wednesday’s early trade

SGXNifty indicates minor cut for the index

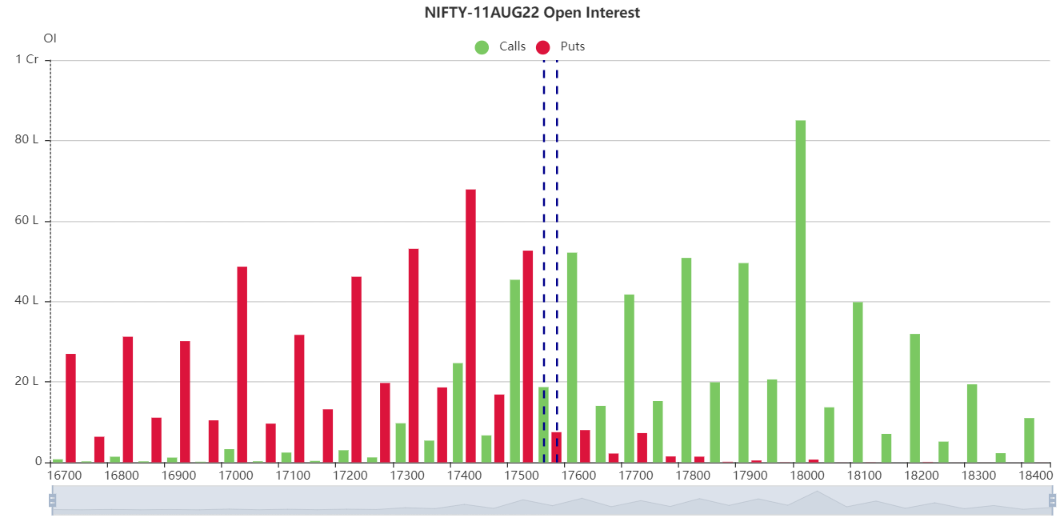

As per open interest data showing 17400PE seems highest OI whereas 18000CE seems highest open interest

However, NiftyFuture is facing a intraday resistance 17575 and 17620

If breaks and manages above 17620 will try to check 17680

On flip side, NF can be considered as supports as 17520, 17490 and 17440

Below 17440, Expecting selling pressure up to 17350

Updated: 08.43 am / 10th Aug 2022