Bankniftyfuture last close: 33253.90 (+0.8%)

On Tuesday, BankniftyFuture was seen too much volatility

BNF was opened 32575 went to 32900 then slipped to 32250 again shot up to 33350

BNF was moved almost 2000 points on yesterday

Volatility index sustained around 28-30

Psu bank index and private bank index gained around 0.5% to 1.5%

Private banks recovered from day’s low

Icicibank, Hdfcbank and Indusindbank did well

SBIN recovered almost 5% from day’s low

Option premium melted in last 30 minutes but still ATM straddle ended around 950

Banknifty index formed a small bodied bullish candle on yesterday after consecutive 5 days fall

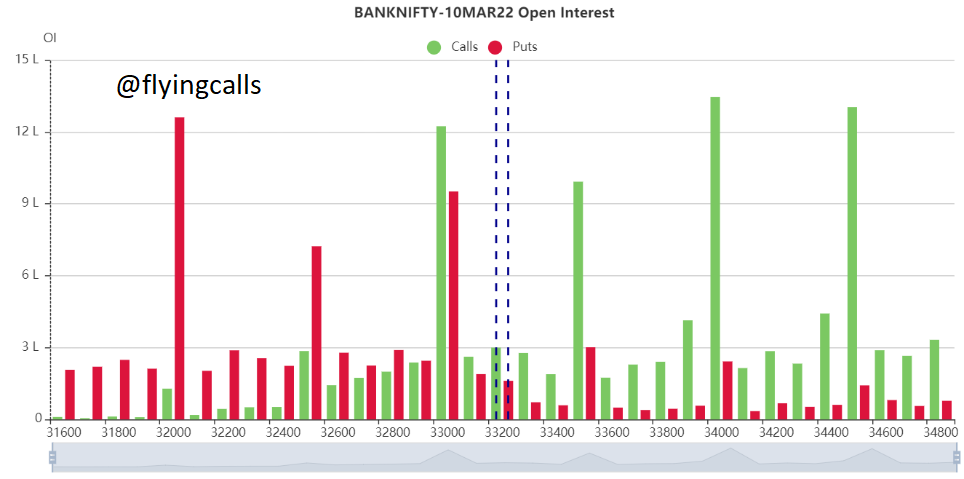

On open interest side, 34000CE added more OI and 32000PE added more OI

Which was indicating a huge volatile will be expected

However, BNF is facing a intraday resistance 33350 and 33550

If breaks and holds above 33550 will try to check 33800-34000

On other side, BNF can be considered as supports as 33050, 32900 and 32650

Below 32650 will tty to check 32200-32300

More live market update will be sent to my clients only

Updated: 08.29 am / 09th March 2022