BankniftyFuture last close: 35010.75 (-0.2%)

On Wednesday, BankniftyFuture was seen highly volatile due to RBI Policy

BNF was opened 35200 then fell to 34930 and shot up to 35555 again fell to 34890

BNF was moved almost 1000 points up and down on yesterday

Private banks was seen selling pressure

Icicibank major contributor to drop the bank index

PSUBank index gained marginally

VIX ended below 20

Option premium was melted after the RBI policy

BankniftyFuture has formed shooting star formation on 08 June

Which means stay caution at higher levels!!

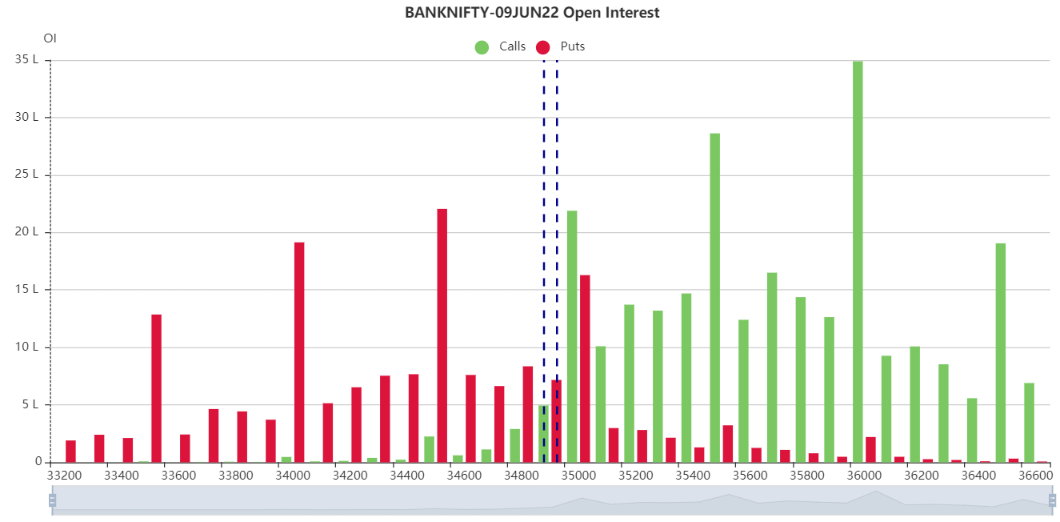

As per OI data showing, CE side added more OI and reduced OI on PE side

However, BankniftyFuture is facing a intraday resistance 35100, 35200 and 35400

Stay caution at higer levels!!

On other side, BNF can be considered as supports as 34800, 34650 and 34500

Below 34500….. expecting more weakness

Updated: 08.36 am / 09th June 2022