Nifty last close: 19611.05 (+0.2%)

The Indian equity indices extended their winning run for the fourth consecutive session on September 6

Nifty was opened 19580 then slipped to 19490 again went tp 19635

Finally, Nifty was up 36.10 points or 0.18 percent at 19,611

Sensex was up 100.26 points or 0.15 percent at 65,880.52

Tata Consumer Products, Divislab, Bharti Airtel, Cipla and HDFC Bank were among the top gainers on the Nifty

While losers included Axis Bank, Hindalco Industries, Tata Steel, ICICI Bank and NTPC

On the sectoral front, FMCG index rose 1 percent

Pharma, oil & gas and power indices gained 0.5 percent each

On the other hand, metal, realty and bank indices down 0.4-1 percent

Midcap and smallcap indices ended on a flat note

Rupee ends at 83.13/$ Tuesday’s close of 83/$

FIIs net sold 3245 crore while DIIs net sold 247 crore on Sept 6

US markets ended lower on Sept 6

Dow down 0.57%, Nasdaq declined 1% and S&P500 fell 0.7%

US VIX ended 14.45

US 10-year yield went to 4.29%

Apple down 4% after the news of China ban the Apple phone to the Govt employee

Brent crude around $91/bbl

Dollar index lower to 104.87

Asian markets were set to negative opening in early trading

HangSeng down 0.8% and Nikkei down 0.1%

Giftnifty indicates a flat opening for the index

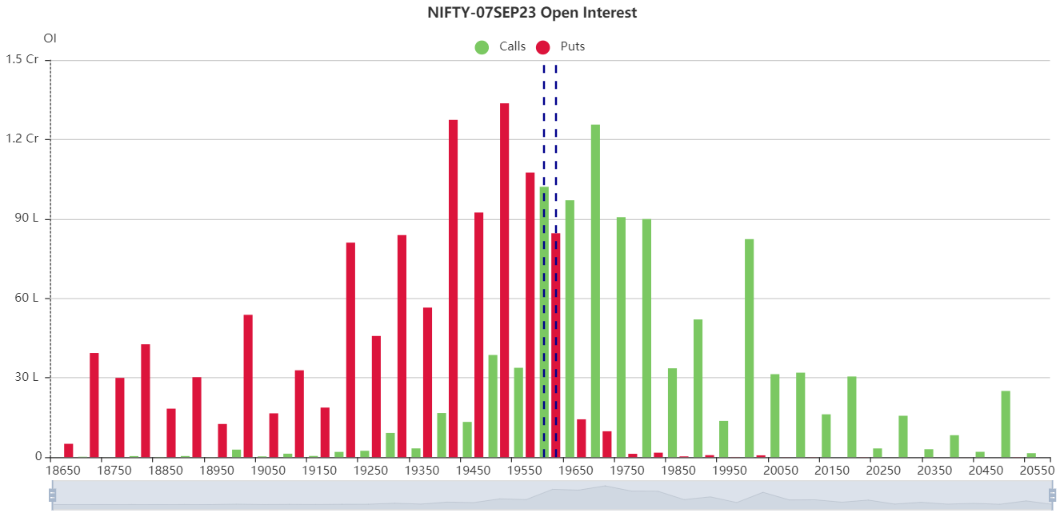

As per open interest 19500PE was seen highest OI

CE sides, seen marginal OI 19600CE, 19650CE and 19700CE

However, Nifty is facing a intraday resistance 19635 and 19650

If stays above 19650 will try to move 19690

On flip side, Nifty can be considered as supports as 19570 and 19530

Below 19530 finding a next support around 19490

Updated: 08.48 am / 07th Sept 2023