NiftyFuture last close :18817.75

On Monday, NiftyFuture was seen highly volatile and ended at flat note

NF was opened 18800 and fell to 18710 then spiked up to 18856 once again fell to 18750

After a long time NF was seen 400 points swing on Dec 5

Sensex was fell 34 points to 62835

Nifty50 gained 5 points to 18701

Metal and PSUBank index rallied around 1% to 1.5%

Pharma, Auto, IT, and Oil & Gal index seen selling pressure

Midcap and Smallcap index seen flat note

VIX sustained around 13.50-13.80

Oil falls over 3% after data raises Fed interest rate worries

Brent crude settld down $2.90 at $82.70/bbl

FIIs net sold 1139 crore while DIIS net bought 2607 crore

GNFC, Deltacorp and Ibullhsgfin ban for F&O on Dec 6

UK consumer spending fails to keep pace with inflation

Euro zone likely heading into mild recession – PMI

Japan October household spending rises for 5th straight month

US future higher followin a close in the red for cash market

US market ends with cuts on Monday

Frontline indices down around 1.5% to 2%

Tesla slips more than 6% on reports of production cut in China

US 10-year yield rises to 3.57% on higher than expected Nov ISM data

US dollar index climbs back above 105

Gold prices slip back below $1780/oz

Asian markets mixed in early trade

Hangseng index down 1.5% and Kospi down 0.7%

SGXNifty indicates negative opening for the index

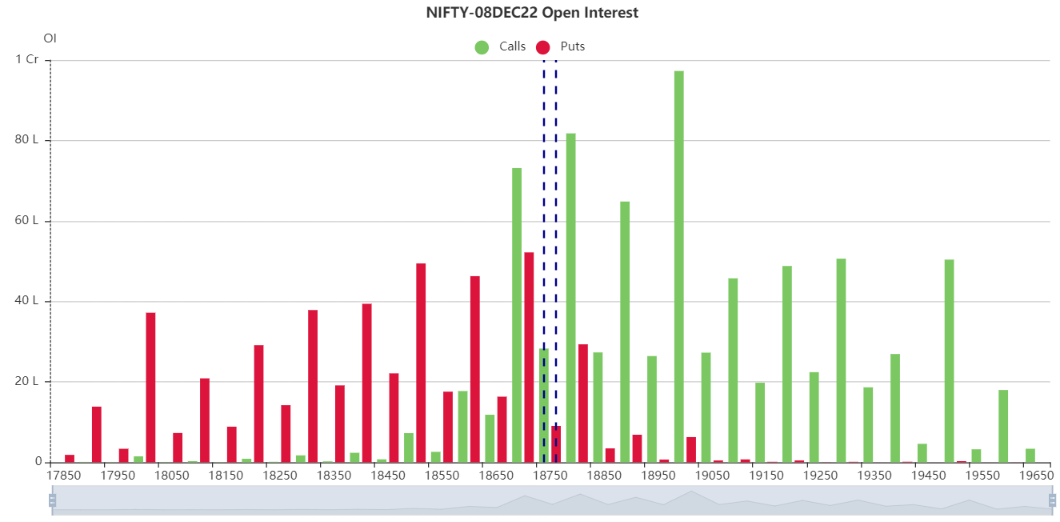

As per open interest CE side added huge OI and PE side there is no significant OI

However, NiftyFuture is facing a intraday resistance 18840, 18865 and 18900

Stay caution at higher levels

On other side, NF can be considered as supports as 18790, 18760 and 18710

Below 18710, finding a next support 18650

Updated: 08.56 am / 06th Dec 2022