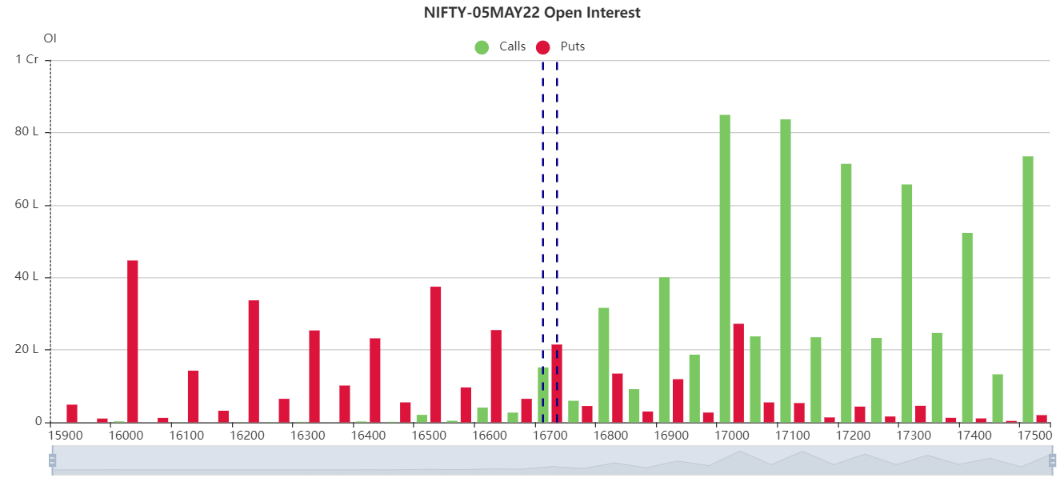

NiftyFuture last close: 16702.50 (-2.2%)

On Wednesday, NiftyFuture slipped more than 2% after the RBI surprise announcement

NF was dropped more than 450 points from day’s high 17135 to 16643

RBI has announced a 40-basis-point hike in the key lending rate and raised the cash reserve ratio (CRR)

By 50 basis points in an unscheduled announcement on May 4

The revised repo rate now stands at 4.40 percent and the CRR at 4.5 percent.

RBI hikes rates for the first time since Aug 2018

10-year yield rises to highest level since 2019

All the sectoral indices ended in the red with auto, bank, FMCG, power, metal, realty, healthcare, capital goods indices down 1-3 percent

BSE midcap index shed 2.63 percent and the smallcap index fell 2.11 percent

LIC IPO day 1 : 67% issue booked and employee portion fully subscribed

FED lifts rates by half point and starts balance sheet reduction June 1

US markets surged up to 4% on Fed’s expected 50 bps rate hike

Fed rulling out 75 bps rate hike is taken positive

10 year US bond yield flat around 2.95%

FIIs net sold 3288 crore while DIIs net bought 1338 crore

Today’s NiftyFuture intraday levels will be sent to my clients as well as 2K pack clients

Join us my Free Telegram channel and you will get open interest analyst charts

Telegram ID https://t.me/FlyingcallsArjun (FlyingcallsArjun)

Updated: 08.52 am / 05th May 2022