Union Budget 2014: Personal income tax exemption limit raised to Rs 2.50 lakh

Union Finance Minister Arun Jaitley today announced no changes to the country’s income tax rate; however the personal income tax exemption limit was raised from Rs 2 lakh to Rs 2.50 lakh.

Union Finance Minister Arun Jaitley today announced no changes to the country’s income tax rate; however the personal income tax exemption limit was raised from Rs 2 lakh to Rs 2.50 lakh.

He also raised 80C exemption limit to Rs 1.5 lakh. This move aimed at boosting household savings. The hike in exemption limit for investments by individuals in financial instruments to Rs 1.5 lakh would come as a sigh of relief for the salaried class blatting high inflation. Presently the investments and expenditures up to a combined limit of Rs 1 lakh get exemptions under Sections 80C, 80CC and 80CCC of the Income-Tax Act.

Investments under 80C up in popular tax saving instruments such as the public provident fund, national savings scheme, unit-linked insurance plans and equity-linked savings schemes are not taxed up to the allowed threshold.

Section 80C was introduced by the UPA government in 2005-06 with a limit of Rs 1 lakh, which was not revised since. While presenting the National Democratic Alliance government’s first Budget in office, Jaitley increased tax exemption limit to Rs 3 lakh for senior citizens.

Exemption on payment of income tax on interest paid on loans for self occupied houses was also raised to Rs 2 lakh from Rs 1.5 lakh. No changes were made to surcharge rates for direct tax and education cess for all tax payers including corporates remains at 3 percent.

During the run-up to the elections, both prime minister Narendra Modi and finance minister Jaitley had spoken about the need to “rationalize” taxes in the country even though the party’s manifesto had stayed away from providing a specific view on the income tax structure.

Union Budget 2014: Jaitley pegs fiscal deficit target at 4.1%, draws roadmap

“We shall leave no stone unturned in creating a vibrant India,” Finance Minister Arun Jaitley started of his Budget speech promising the country a being watchful of the current account deficit.

“We shall leave no stone unturned in creating a vibrant India,” Finance Minister Arun Jaitley started of his Budget speech promising the country a being watchful of the current account deficit.

He said the government has to ensure anti-poverty programme is well targeted. Jaitley pegged the FY15 fiscal deficit target at 4.5 percent, but added that he will try to meet the 4.1 percent fiscal deficit target set by his predecessor. He pegged the FY16 fiscal deficit target at 3.6 percent, while for FY17 the target he is working on is 3 percent.

“My predecessor (P Chidambaram) had set up a very difficult task of reducing the fiscal deficit to 4.1 per cent of GDP in current year… the target in indeed daunting. Difficult as it may appear, I have decide to accept this target as a challenge,” he said.

The fiscal deficit which had touched a high of 5.7 per cent in 2011-12, was brought down to 4.8 per cent in 2012-13 and further to 4.5 per cent in 2013-14. The reduction in fiscal deficit by the UPA government, Jaitley said, was mainly achieved by a reduction in expenditure rather than by way of realisation of higher revenues.

Jaitley said there are challenges to lowering the fiscal deficit as the country had two years of low GDP growth, a almost static industrial growth, a moderate increase in indirect taxes, a large subsidy burden and not so encouraging tax buoyancy.

“The task before me is very challenging because we need to revive growth, particularly in manufacturing sector and infrastructure,” he said, adding choice has to be made whether or not to be victims of mere populism and wasteful expenditure. Talking about the external sector, Jaitley said there was a “turnaround” in the current account deficit (CAD) situation in 2013-14.

The CAD, which is the difference between inflows and outflows of foreign exchange, was brought down to 1.7 per cent of GDP in 2013-14, from a record 4.7 per cent in the previous year. Jaitley said he was conscious of the fact that Iraq crisis is leaving behind an impact on oil prices and that the situation in the Middle East continues to be volatile.

IBM to bet $3bn over 5-yrs hoping for breakthrough in chips

IBM announced on Wednesday it will invest USD 3 billion over the next five years in chip research and development in hopes of finding a game-changing breakthrough that can help revive its slumping hardware unit. IBM announced the plan a week before its widely anticipated second quarter earnings.

Last quarter, sales in its hardware sector plunged 23 percent from a year earlier and the company posted its lowest quarterly revenue in five years. IBM hopes to find ways to scale and shrink silicon chips to make them more efficient, and research new materials to use in making chips, such as carbon nanotubes, which are more stable than silicon and are also heat resistant and can provide faster connections.

“The message to our investors is that we are committed to this space, we believe there is great innovation possible that will be necessary in world of big data analytics, said Tom Rosamilia, senior vice president of IBM’s Systems and Technology Group. “These are essential ingredients in delivering the kind of performance the world will demand. The world is demanding it now and will continue to demand it for the next 10 years,” he said. The investment is equal to half of all IBM’s research and development last year.

The company is preparing to divest its chip manufacturing business to focus on intellectual property. The company is rumored to be close to a deal with chipmaker Globalfoundries Inc. At an investor briefing in May, IBM’s Chief Financial Officer Martin Schroeter said new research and development was essential to refreshing the hardware sector, which he expects to stabilize in 2014 and grow in 2015. Silicon chips, which have been made smaller every year, are reaching a point of diminishing returns, preventing chips from delivering performance improvements demanded by new technology, the company said.

Union Budget 2014: Presentation by Hon’ble Finance Minister in Parliament of India

httpv://youtu.be/_S2NF0Fek6g

10th July’14 Nifty Future Update

NIFTY FUTURE Closed: 7598

Yesterday Nifty Future was very very Volatile

We have written NF Resistance 7670….. Made a high of 7669.70

Then slide upto 7567.75

We have Recommend Selling alert @ 7665 & Booked Profit at 7615

Again given Buying alert & Stop-loss triggered 20 points!!!

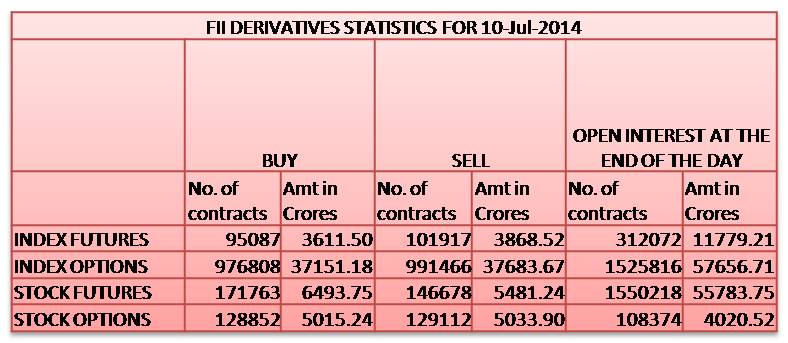

Yesterday too FII’s sold around 600cr in Index

Last Three sessions FII’s net sold around 2000cr

![]()

BUDGET DAY & BIG VOLATILE DAY

Today can trade only for Risky traders or Lion Heart traders

Others better to stay away!!!

Because huge volatile will be expected……..

Some Brokers Today not given Exposure more then 3 times

Today’s Nifty Future Resistance 7625 & 7655 levels

After Budget if stays above 7655 with 15 minutes………..

We see Rally upto 7710, 7770 & 7860 chances are remote only

Suppose after Budget if stays below 7540………..

We see Blood Bath upto 7485 & 7445 Thereafter 7350+

Tight your seat belt……

101% Live market update to our clients only…….

Updated : 08.57am / 10th July’14

10th July’14 Banknifty Future Levels

Banknifty Future closed : 15016

Today high volatile day……….. Take care

Today’s BNF Supports 14940 & 14860 levels

If stays below 14860……….. will see Blood bath upto 14700 & 14500 not ruled out!!!

Today’s Resistance 15090 & 15180 levels………..

Final & hurdle level 15330………… Thereafter big blast!!!

More update to our clients only

Updated : 08.51am / 10th July’14

10th July’14 Hot Calls

RELCAPTIAL

RELCAPITAL strong support level 578

Closely watchout this level…….. once if breaks the level

We see another panic upto 570, 563 levels thereafter 540

Keep tight stop-loss ??

Gold Stocks

In Budget if cut Import duty

We see big Rally on below stocks

TITAN, Muthoot, PCJeweller, Gitanjali, and more ??

If not cut ???????? Yes, Blood bath on the card!!

DLF

DLF now near by strong support level

Today once if breaks the level……… Free Fall will be expected upto 10% to 20%

Which level will be break ??

Clients special call

Updated : 08.35am / 10th July’14

Chidamabaram appreciates restrained language of Eco Survey

Former Finance Minister P Chidambaram today appreciated the restrained language of the pre-Budget Economic Survey but expressed disappointment over it envisaging a five year period to put in place reforms.

Reacting to the Survey tabled in Parliament today, he said he was glad that it acknowledged the measures taken by the UPA government on macro stabilisation front and the successes achieved in containing the current account deficit and reducing the fiscal deficit.

“I appreciate the restrained language of the Economic Survey 2013-14 that has resisted the temptation (as the UPA resisted in 2004) to point an accusatory finger at the outgoing government,” he said in a statement. Referring to the chapters on the state of the economy and issues in priority, Chidambaram said he was glad that the Survey has noted several significant developments – the increase in foreign exchange reserves, the decline in WPI inflation from 8.9 per cent to 7.4 per cent to 6.0 per cent and the restoration of exchange rate stability.

“The Survey has correctly placed the slowdown witnessed in the last two years in the global context marked by the Euro crisis, general slowdown of the global economy and the declining growth in the merging markets and developing economies including China. The Survey has also appreciated the measures taken by the UPA government and the RBI in mid-July 2013, ” he said.

Chidambaram welcomed the declaration of the NDA government that “the emphasis of policy would have to remain on fiscal consolidation and removal of structural constraints”. “I am in broad agreement with the ‘issues and priorities’ identified in Chapter 2, particularly the affirmation of the ‘reforms agenda’ and the advocacy of the GST and DTC. I also welcome the statement that the ‘Indian financial code is on the legislative agenda’.