18th April 2024 #Nifty Intraday Levels and Pre-Market Reports

Nifty last close: 22147.90 (-0.56%)

Market falls for 3rd straight session for the 1st time in 3 months

Contributed to the decline included the threat of higher-for-longer interest rates, tensions in the Middle East

On Tuesday, Nifty was down 124.60 points, or 0.56 percent, at 22,147.90

Sensex was down 456.10 points, or 0.62 percent, at 72,943.68

The biggest losers on the Nifty included Infosys, LTIMindtree, IndusInd Bank and Bajaj Finserv

while the gainers were Eicher Motors, Hindustan Unilever, Oil & Natural Gas Corp. Titan Co., and Divi’s Lab

Nifty IT index plunged 2.6 percent

Nifty PSU Bank and Nifty Bank indexes, down 1.3 percent

Nifty Media gained the most, rising 1.57 percent

Followed by the Nifty Oil & Gas and the Nifty Pharma, which increased 0.6% and 0.4%, respectively

Rupee Ends At A Record Low Of 83.54/$

Infosys to announce Q4 earnings today also Bajajauto declaring the earnings report

IMF raises India’s FY25 GDP growth forecast by 30 bps to 6.8%

NSE to stop issuing new futures and options contract for Zee Entertainment

Foreign institutional investors (FIIs) net sold shares worth Rs 4,468.09 crore

while domestic institutional investors (DIIs) purchased Rs 2,040.38 crore worth of stocks on April 16

US markets ended lower on April 17

Dow lost 0.12%, Nasdaq declined 1.15% and S&P500 dropped 0.58%

Nasdaq down for 4th straight session

Dow down 7th session out of eight session

US VIX ended at 18.21

Nvidia fell 4% and Netflix and Meta down

Gold prices fall near $2370/oz

Dollar index near 106

US 10-year yield fall to settle at 4.58%

Asian markets were set to open higher

Kospi up 2% and Hangseng rises 0.6%

GiftNifty indicates a positive opening for the index

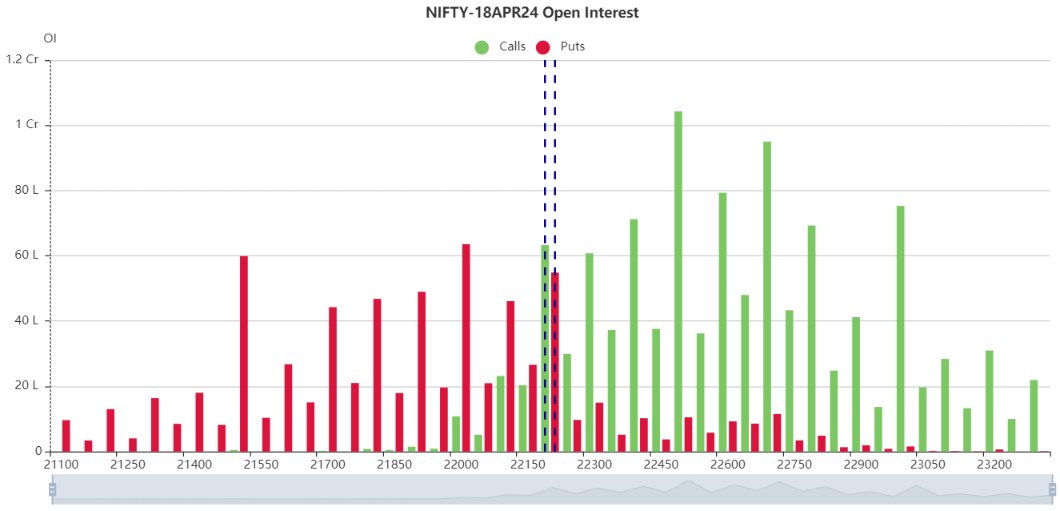

Nifty is facing a intraday resistance 22180 and 22220

If stays above 22220 will try to move 22260

On other side, Nifty considering a supports 22130 and 22100

Below 22100 finding a next support around 22060

Updated: 08.56 am / 18th April 2024

18th April 2024 #Banknifty Intraday Levels

Banknifty last close: 47484.80 (-0.6%)

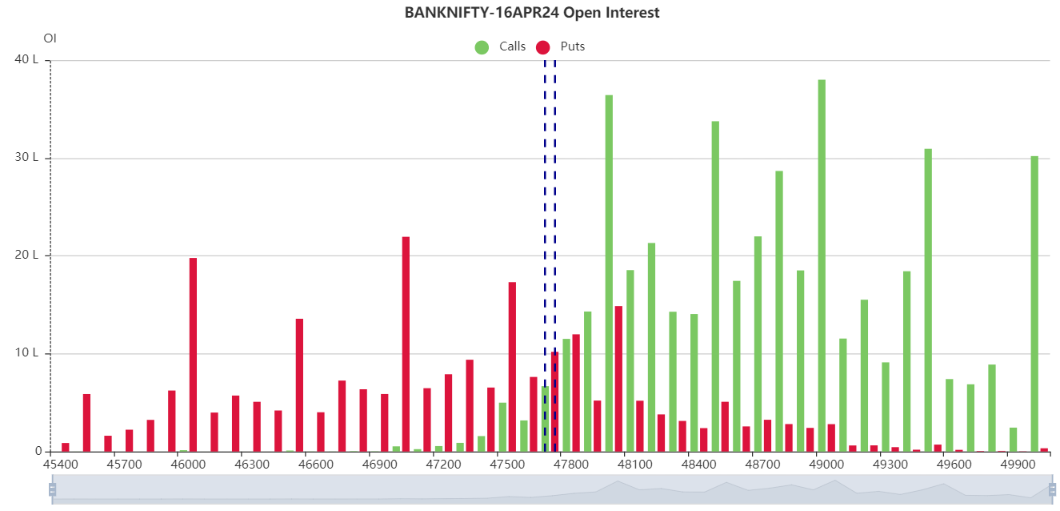

Today Banknifty is facing a intraday resistance 47600 and 47700

If stays above 47700 will try to move 47850

On other side, Banknifty considering a supports 47400 and 47300

Below 47300 finding a next support around 47150

Updated: 08.34 am / 18th April 2024

#ThursdayThoughts #ThursdayMotivation

16th April 2024 #Nifty Intraday Levels and Pre-market reports

Nifty last close: 22272.50 (-1.1%)

The Indian equity indices extended losses for the second consecutive session on April 15

Nifty was opened 22350 then fell to 22360 again shot up to 22400 then erased the intraday rally

Finally, Nifty was down 246.90 points, or 1.10 percent, at 22,272.50

Sensex was down 845.12 points, or 1.14 percent, at 73,399.78

Biggest losers on the Nifty included Shriram Finance, Wipro, Bajaj Finance, ICICI Bank

while gainers were ONGC, Hindalco Industries, Maruti Suzuki, Nestle

Among sectors, except oil & gas and metal, all sectoral indices ended in the red

midcap and smallcap indices were down 1.5 percent each

VIX shot up 8% to 12.50

IMD SAYS INDIA’S MONSOON RAINFALL SEEN ABOVE NORMAL IN 2024

CRISIL EXPECTS RBI TO INITIATE REPO RATE CUTS FROM MID-2024

WPI INFLATION YOY ACTUAL: 0.53% VS 0.20% PREVIOUS FORECAST 0.7%

Foreign institutional investors (FIIs) net sold shares worth Rs 3,268 crore

while domestic institutional investors (DIIs) purchased Rs 4,762.93 crore worth of stocks on April 15

Life Insurance Corporation hikes stake in Hindustan Unilever

The stake was increased from 4.99 percent to 5.01 percent, according to the filing

US markets ended sharply lower on April 15

Dow down 0.65%, Nasdaq declined 1.78%, S&P500 fell 1.2%

S&P500 fell more than 100 points from day’s high

Dow down 2000 points from recent high

US VIX up 11% to 19.23

Goldman Sachs beats estimates and stock up 2.9%

Tesla falls 2.8% post reports of layoff in global workforce

Gold near record high $2385/oz

The U.S. dollar index touched 106.27, the highest since Nov. 2

Brent futures for June delivery rose 46 cents, or 0.5%, to $90.56 a barrel

China Q1 GDP above estimates at 5.3% YoY vs Estimate of 4.8%

Asian markets were set to sharply lower opening

Nikkei down 2% and Hangseng down 1.5%

GiftNifty indicates a gap down opening for the index

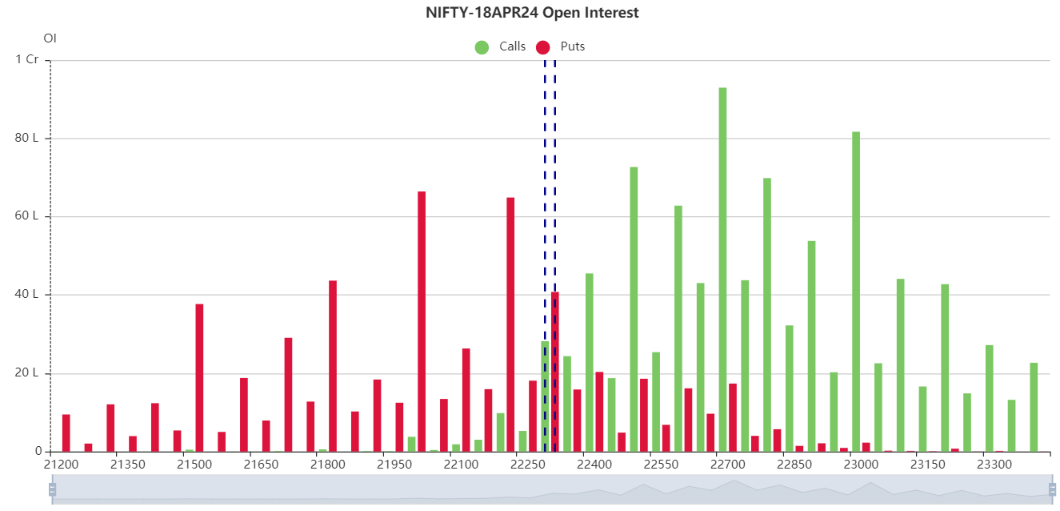

Nifty is facing a intraday resistance 22300 and 22350

If stays above 22350 will try to check 22400

On flip side, Nifty considering a supports 22240 and 22200

Below 22200 finding a next support around 22140 and 22050

Updated: 08.54 am / 16th April 2024

16th April 2024 #Banknifty Intraday Levels

Today’s Banknifty intraday levels and open interest data will be sharing to my free telegram channel

Free Telegram channel link is https://t.me/FlyingcallsArjun

Updated: 08.42 am / 16th April 2024