12th April 2024 #Nifty Intraday Levels and Pre-Market Reports

Nifty last close: 22753.80 (+0.49%)

On Wednesday Nifty was seen range with positive bias

Finally, Nifty was up 111 points, or 0.49 percent, at 22,753.80

Sensex was up 354.45 points, or 0.47 percent, at 75,038.15

Nifty Midcap 100 and Bank Nifty also touched their respective record highs in today’s session

Except pharma, all other sectoral indices ended in the green

Media, PSU Bank, FMCG, metal, oil & gas stocks were up 1-2 percent

March SIP inflows at ?19,271 Cr vs ?19,187 Cr (MoM)

Smallcap mutual funds saw outflows for the first time in 30 months in March

Smallcap funds saw a net outflows of Rs 94 crore in March against net inflows of Rs 2,922.45 crore in February

The last time smallcap funds saw net outflows, of Rs 249 crore, was in September 2021

Inflows into midcap funds slumped 44 percent to Rs 1,018 crore against net investments of Rs 1,808.18 crore in February

Largecap funds as inflows into the category jumped 131 percent to Rs 2,128 crore in March

Foreign institutional investors (FIIs) net bought shares worth Rs 2,778.17 crore

while domestic institutional investors (DIIs) purchased Rs 163.36 crore worth of stocks on April 10

India’s largest IT services company TCS is going to announce earnings for the fourth quarter on April 12

US markets was seen highly volatile in last two days

On Wednesday US ended huge selling pressure and fell 1% in frontline indices after CPI inflation

On Thursday The Producer Prices index (PPI) came in softer than expected

Supporting the narrative that price growth is still cooling

Dow ended flat note, Nasdaq gained 1.7% and S&P500 rallied 0.8%

US VIX fell 8% to 14.9

Apple rises 4.3% after the positive report from company

Nvidia ends 4% higher and Amazon jumps all time high

US 10year yield rises above 4.5%

Crude rises above $90/bbl

Gold hits all time high $2385/oz

Dollar index above 105

ECB holds rates at record highs, signals upcoming cut

Asian markets open mixed and Hangseng down 2%

GiftNifty indicates slightly negative for the index

Nifty is facing a intraday resistance 22780 and 22810

If stays above 22810 will try to check 22860

On flip side, Nifty considering a supports 22725 and 22700

Below 22700 finding a next support around 22640

Updated: 08.54 am / 12th April 2024

12th April 2024 #Banknifty Intraday Levels

Banknifty last close: 48986.60 (+0.53%)

Today Banknifty is facing a intraday 49100 and 49200

If stays above 49200 will try to move 49350

On flip side, Bankifty considering a supports 48900 and 48800

Below 48800 finding a next support 48650

Updated: 08.34 am / 12th April 2024

#FridayThoughts #FridayMotivation

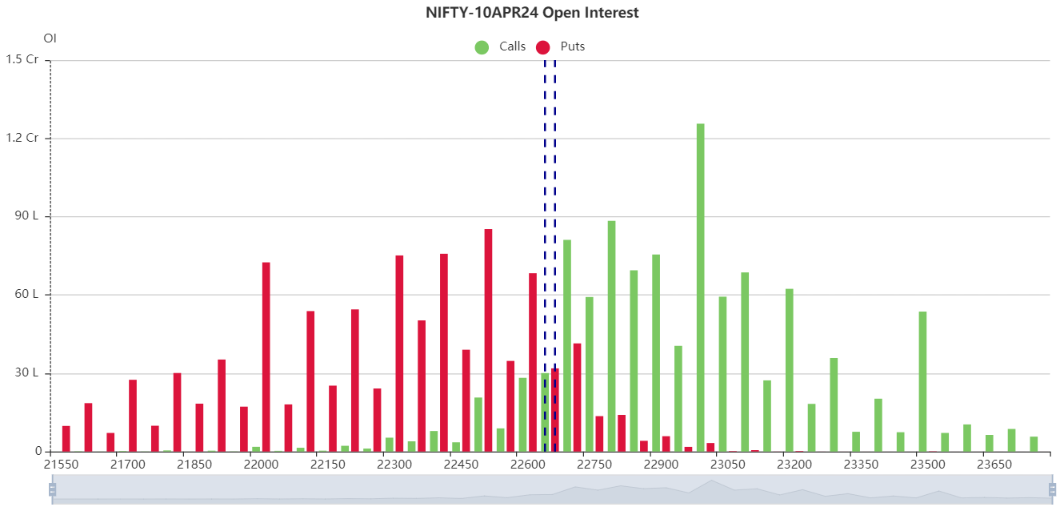

10th April 2024 #Nifty Intraday Levels and Pre-Market Reports

Nifty last close: 22642.75 (-0.1%)

Indian benchmark indices the Sensex and the Nifty scaled fresh lifetime highs on April 9

But failed to hold on the gains as profit booking ahead of the release of key inflation figures for India and the US

Finally, The Nifty also pared to slipped from its new peak of 22,768.40 to close 24.50 points, or 0.11 percent lower, at 22,641.80

Sensex settled 58.80 points, or 0.08 percent, lower at 74,683.70

Top Nifty gainers were Apollo Hospitals, Hindalco, ICICI Bank and Infosys

while losers were Titan Co, Hero MotoCorp, Coal India and Reliance Industries

As for sectors, auto, capital goods, FMCG, energy, infra, oil and gas and pharma closed with 0.3-1 percent losses

while banks, metals and realty indices were rose 0.3-1 percent

midcap index also slipped 0.5 percent and the smallcap index shed 0.2 percent

ICICI Lombard enters into a strategic partnership with Policybazaar

Skymet is expected to see a ‘normal monsoon’ in 2024

Hinduja Group’s IIHL acquires 60% stake in Invesco India Asset Management

Vendanta gets an upgrade by CLSA

Foreign institutional investors (FIIs) net sold shares worth Rs 593.20 crore

while domestic institutional investors (DIIs) bought Rs 2,257.18 crore worth of stocks on April 9

US markets ended flat note ahead of US CPI reading

US 10-year yield at 4.35%

Crude falls below $90/bbl

Gold sustains near record high $2350/oz

Asian markets mixed in early trade

GiftNifty indicates a positive note for the index

Nifty is facing a intraday resistance 22675 and 22700

If stays above 22700 will try to check 22740

On other hand, Nifty considering a supports 22620 and 22590

Below 22590 finding a next support around 22540

Updated: 08.42 am / 10th April 2024

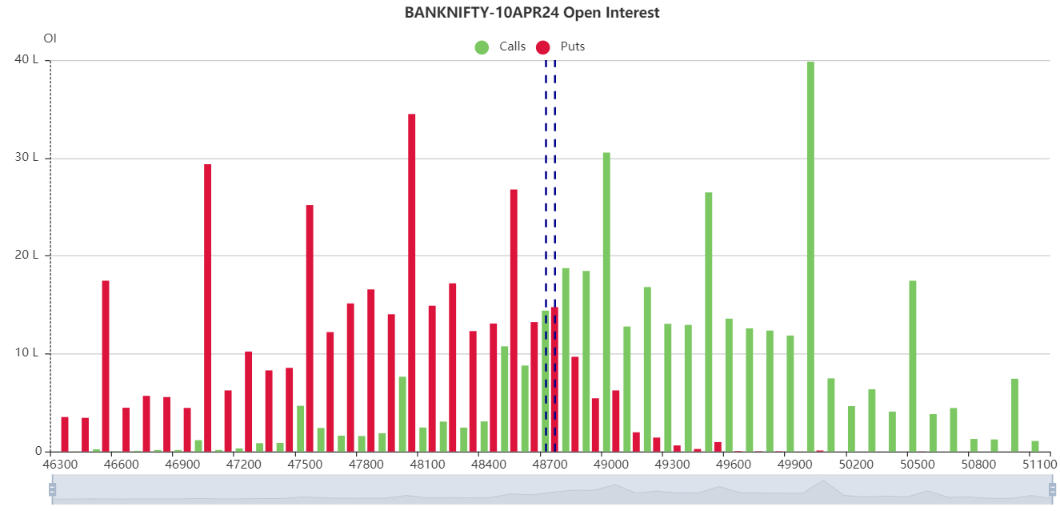

10th April 2024 #Banknifty Intraday Levels

Banknifty last close: 48730.55 (+0.31%)

Today Banknifty is facing a intraday resistance 48800 and 48880

If stays above 48880 will try to move 49050

On other side, Banknifty can be considered as supports as 48650 and 48580

Below 48580 finding a next support around 48450

Updated: 08.22 am / 10th April 2024