BankniftyFuture last close: 34487.10 (-1.9%)

BankniftyFuture was ended almost 2% down on 20 July

In last three sessions, BNF was fell more than 1500 points from 36075 to 34440

Hdfcbank and Icicibank was most contributor to push the bank index

HDFCBank was fell more than 5% after weak earnings report

Icicibank will be declaring the earnings report on 24th July

Volatility index spiked 4% on Tuesday

BankniftyFuture was formed a big bearish candle on last consecutive three sessions

SGXNifty indicate a gap up opening and following by Bank index but will is sustain or not ?

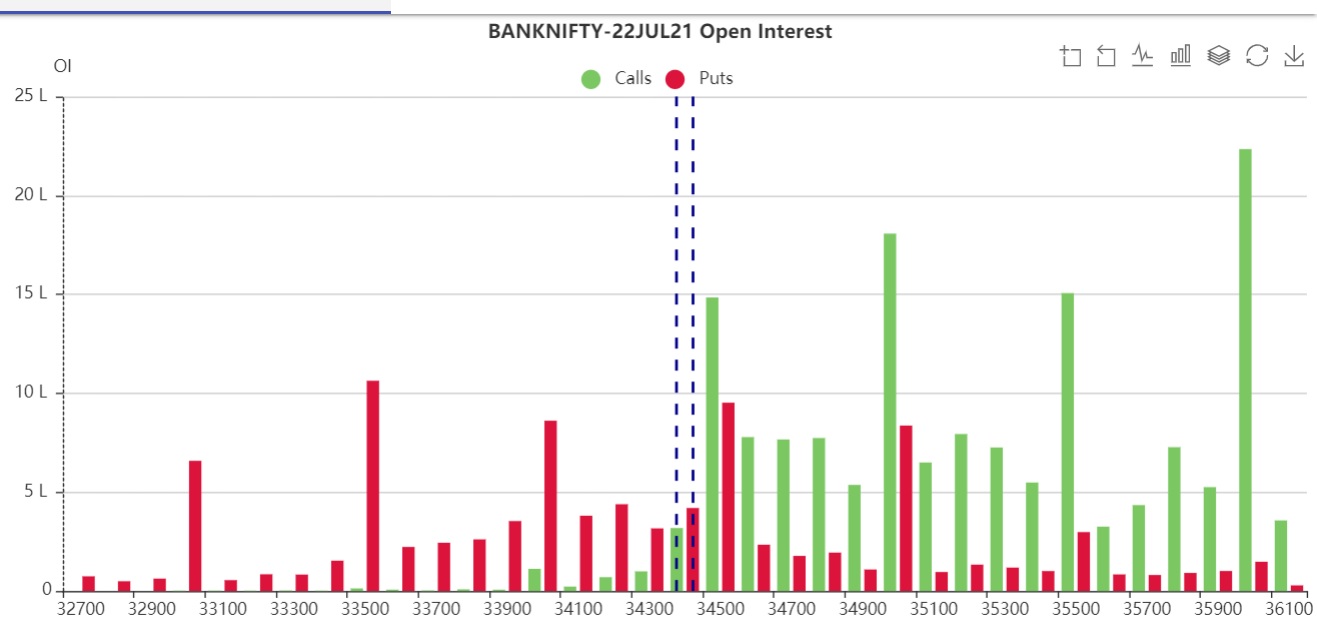

As per Tuesday’s closing Open Interest 35000CE and 34500CE was seen highest OI and PE side 33500PE added more OI (33500PE and 36000CE maybe on hedge OI so not to consider)

However, BankniftyFuture is facing a intraday resistance 34650 and 34800

If sustains above 34800 will try to check 35000

BNF can be considered as supports as 34500, 34440 thereafter 34275

More live market update will be sent to my clients only

Updated: 08.21 am / 22nd July 2021